$429 a Month: The Cost of Upgrading Homes in the DC Area

$429 a Month: The Cost of Upgrading Homes in the DC Area

✉️ Want to forward this article? Click here.

With how constrained the housing supply is throughout the country, the ability for a homeowner to trade-up for a larger home can often seem like wishful thinking — especially in a market as pricey as the DC area.

However, a recent Zillow report shows that homeowners in the region often pay a smaller monthly premium to purchase a house with additional bedrooms than homeowners nationwide.

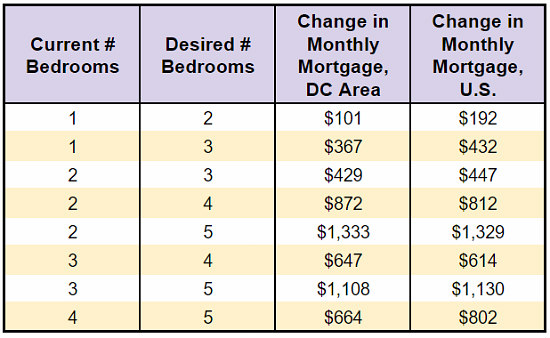

The median increase in monthly mortgage payments for additional bedrooms

While the average American family could expect to pay $447 extra per month for a mortgage on a three-bedroom house compared to a two-bedroom house, DC-area families would actually pay $429 extra to make the same move. The average trade-up premium for a move from a two-bedroom to a three-bedroom in a high-demand coastal housing market is over $500.

story continues below

loading...story continues above

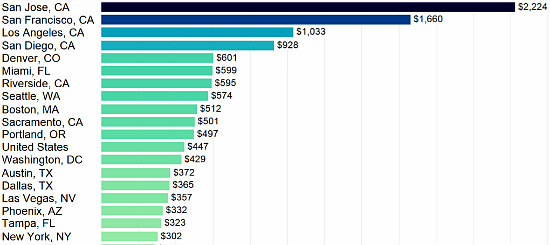

The top area trade-up premiums from two- to three-bedrooms

A trade-up from a four-bedroom to a five-bedroom in the DC area is actually markedly less expensive than it would be for the typical American family in the overall nationwide market.

The San Jose and San Francisco metro areas of California are vastly more expensive where monthly trade-up costs are concerned than any of the other 35 largest regions studied; for example, a family moving from a two-bedroom to a three-bedroom would pay an additional $2,224 and $1,660 respectively every month for a mortgage.

Because the US Census Bureau’s American Community Survey showed that families with small children tend to spend seven years at a time in their home, Zillow compared the mortgage payments for a median valued home in each zip code in 2009 to those of a median-valued home in 2016, extrapolating that data to the larger metropolitan area. The premium on an additional bedroom also assumes that the trade-up house is larger. Zillow’s report also features a tool that allows you to compare your current monthly mortgage to what it would cost to purchase a different home now.

See other articles related to: housing market, housing prices, zillow

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/the_trade-up_home_purchase_premium/12411.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro