The State of the Nation's Housing

The State of the Nation's Housing

✉️ Want to forward this article? Click here.

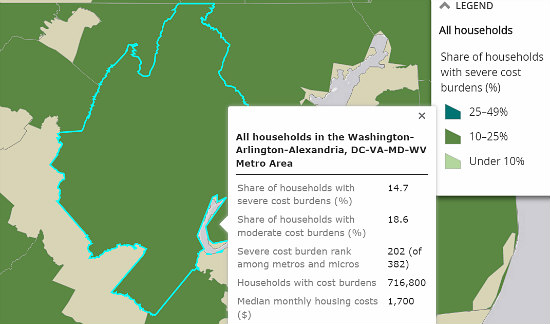

Housing cost burdens in the DC metro area

The Joint Center for Housing Studies (JCHS) recently released their annual State of the Nation’s Housing report, which reveals how the inverse relationship between homeownership and rental rates across the country has led to an increase in households in which housing costs are severely burdensome.

Following the housing crisis in 2008, a wave of foreclosures, more-stringent credit standards to attain mortgages and other factors such as student loan burdens, the country’s homeownership rate is now much lower.

Despite a relatively strong recovery for housing construction starts, the rental market has become the main driver of the housing recovery. The JCHS report states that “rental demand has risen across all age groups, income levels, and household types, with large increases among older renters and families with children.” The resultant five-year drop in rental vacancies has led to inflated rents and a greater share of cost-burdened renter households.

story continues below

loading...story continues above

Conversely, the share of cost-burdened homeowners has decreased, partially due to foreclosures pushing financially-strained homeowners out of the market.

Overall, the report finds that at least one in 10 households nationwide are severely cost-burdened, with an average of 10-25 percent of households spending more than half of their income on housing in most metropolitan areas. An additional 17 percent of all households spend 30-50 percent of their income on housing, which qualifies them as moderately cost-burdened.

The DC area is no exception to these broader trends. The report shows that 14.7 percent of all households in the region, where median housing costs are $1,700 a month, deal with severe cost burdens. An additional 18.6 percent of DC-area households are moderately cost-burdened.

Housing costs for renters, as defined by the JCHS report, are a gross measure including both rent and utilities, while costs for homeowners include mortgage, property taxes, insurance, utilities and additional homeowner fees. As with many nationwide housing studies, the DC metropolitan area includes a broad swath of the city’s suburbs, from Gaithersburg down through Reston and including Jefferson County, West Virginia.

See other articles related to: housing policy, housing reports, rent affordability

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/the_state_of_the_nations_housing/11410.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro