What's Hot: Just Above 6%: Mortgage Rates Drop To 2022 Lows | Facebook Co-founder Lists DC Home For Sale

The Rent vs. Buy Calculator Put to The Test

The Rent vs. Buy Calculator Put to The Test

✉️ Want to forward this article? Click here.

The question of whether to buy or rent can be an algorithmic nightmare to untangle. The process has gotten much easier, however, since New York Times graphic editors Kevin Quealy and Archie Tse created a Rent vs. Buy calculator that integrates nearly all conceivable factors that go into the decision-making process.

“The tool is an interactive calculator that uses formulas to calculate the year-by-year costs of buying and renting,” Kevin Quealy told UrbanTurf. “It then determines which is cheaper after each year.”

The calculator asks users to input their current monthly rent and the home price they’d likely purchase at, as well as variables like a down payment percentage, probable mortgage rate, annual property taxes, and the rate of home value appreciation and rent increases in their area. What the calculator spits out is a graphical representation of the time it takes for one to break even on their investment, and the return on that investment going forward. The calculator also lets you compare figures across a theoretical number of years lived in the property, so you can see the cumulative savings or loss.

“All the metrics it takes into consideration are inputs on the calculator, so there are no ‘hidden’ inputs,” Quealy explained.

We decided to put the calculator to the test for three hypothetical buyers.

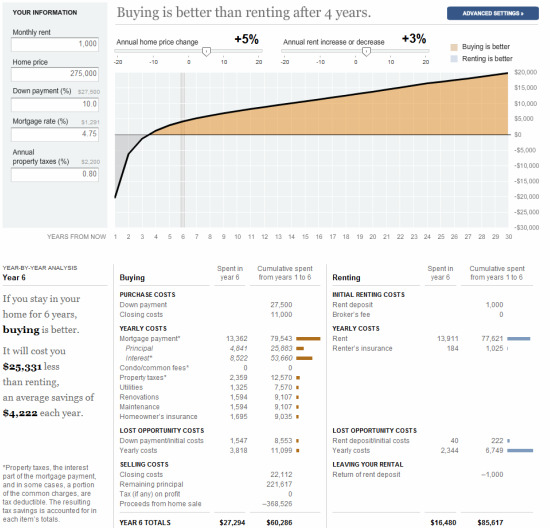

Adrian — 26-year-old teacher living in Logan Circle

Adrian is paying $1,000 a month for a 500 square-foot studio apartment. He’d like to buy a similar space in the area for $275,000 and knows that he has enough savings for a 10% down payment. He’s preapproved for a 4.75% fixed rate mortgage, and knows that he’ll pay about $1,800 in property taxes annually. It turns out that Adrian will break even on the investment after four years if the property appreciates at 5% and he avoids paying rent at an expected annual 3% increase. If Adrian stays in the property for five years then he’ll save $14,809 over renting, but if he picks up and leaves only to sell his place after three years he’ll have lost $4,067.

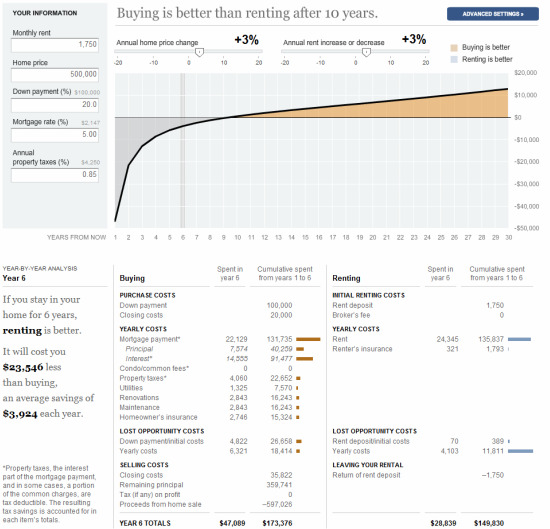

Ninette — 35-year-old doctor living in the SW Waterfront

Ninette, a 35 year-old doctor, is ready to buy a house with her fiancé. They currently rent a two-bedroom apartment together in Southwest Waterfront for $1,750 a month and would like to purchase a three-bedroom home in the $500,000 range near Hill East. They’ve been approved for a 5% mortgage rate and plan to put a 20% down payment on their house, but Ninette notices from looking at comps and talking to her agent that the houses in the part of Hill East where they’d like to buy only appreciate at about 3% a year. Assuming a 3% increase in their annual rent, it would take Ninette and her fiancé ten years to break even on their investment. Staying fifteen years would net them about $62,000, but staying five years less than expected would result in a loss of about $28,000.

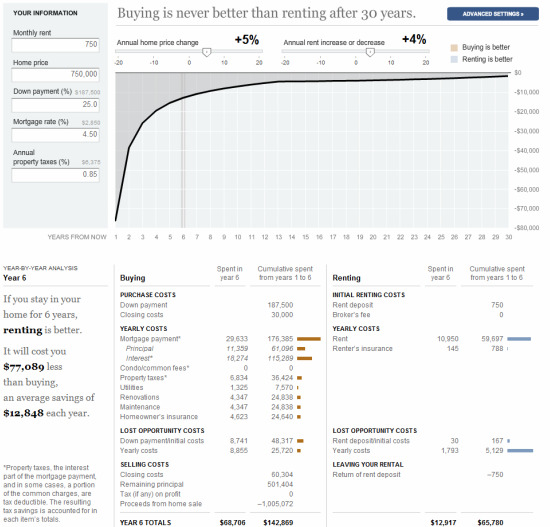

Alejandro — 57 year-old businessman renting a one-bedroom

Alejandro is a 57-year-old businessman would has spent most of his working life in a modest one-bedroom apartment in Southwest, saving year after year so that he could upgrade eventually to a two-bedroom condo near Dupont Circle when he retires. He currently pays just $750 a month in rent, but has saved enough for a 25% down payment on a $750,000 unit with a 4.5% interest rate mortgage. Alejandro estimates that his property will appreciate 5% annually in Dupont Circle based on the appreciation of similar units, but even with his 4% annual rent increases it would take him 23 years to break even on the investment.

Before taking the calculator’s conclusion as the final word on whether or not you should continue to rent or dive in and buy, keep in mind a few things. First, make sure to use the Advanced Settings button in the upper right, which allows you to set even more variables, including condo fees, monthly utilities, and closing costs. Also realize that even though the tool appears on the New York Times website, there is nothing New York-specific about it. Because it allows you to input essentially every variable and cost that goes into home buying or renting, you are able to enter in values specific to your own area. Lastly, approximating home appreciation and rental increases is tough in a time when both can fluctuate significantly from year to year, but the value is crucial. Missing your projected home appreciation by even one percent can cause your return-on-investment schedule to change by a year or more.

That said, by taking into account estimated closing costs, utilities, renovations and maintenance, homeowner’s insurance, and even lost opportunity costs, this Rent vs. Buy calculator is probably the closest thing in terms of an objective second opinion that you can get today.

See other articles related to: editors choice, rent vs buy

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/the_rent_v._buy_calculator_put_to_the_test/2554.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- Church Street, U Street + Reeves: A Look At The 14th Street Development Pipeline

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro