What's Hot: A New Plan For The H Street Corridor

Senate Passes Bill to Extend Homebuyer Credit

Senate Passes Bill to Extend Homebuyer Credit

✉️ Want to forward this article? Click here.

The Senate voted late Wednesday to extend the $8,000 first-time home buyer tax credit.

In short, the credit would be extended to home purchases under contract by April 30, 2010, and closed on by June 30th. It would be available to individuals earning up to $125,000, or $225,000 for couples, up from $75,000 for individuals and $150,000 for couples under the current law. The proposal would also let existing homeowners qualify for a $6,500 credit if they have lived in their current residence for five years.

This extension of the credit is included in a bill that will also extend unemployment benefits. The measure now goes to the House where it is expected to be supported, and could be voted on as early as Thursday morning. This means that it could be on President Obama’s desk for signature as early as next week.

From CNN:

The extension will cost $10.8 billion over 10 years, according to the Joint Committee on Taxation.

Through mid-September, 1.4 million tax returns had qualified for the credit, according to the IRS. Some portion of those returns, which the IRS couldn’t specify, represents buyers who took advantage of an earlier version of the tax credit, which was only worth $7,500 and has to be repaid over time.

By the end of November, the credit will have been used by 1.8 million homebuyers, at least 355,000 of whom would not have bought a house without the tax break, according to estimates by the National Association of Realtors.

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/senate_passes_bill_to_extend_homebuyer_credit/1480.

Most Popular... This Week • Last 30 Days • Ever

The differences between condo fees and co-op fees might seem small, but there are som... read »

Architecture firm Torti Gallas has been picked to conduct a land use and market study... read »

For our first development rundown of the year, UrbanTurf catches up on the latest new... read »

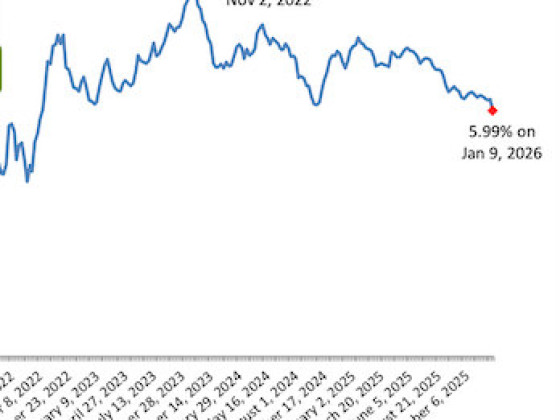

The benchmark rate fell to 5.99%, marking a significant psychological threshold for a... read »

More details on White House ballroom; the sectors fueling growth for the DC office wo... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro