May Home Sales Were Up, But Appraisal Problem Clouds Outlook

May Home Sales Were Up, But Appraisal Problem Clouds Outlook

✉️ Want to forward this article? Click here.

The National Association of Realtors (NAR) reported this morning that existing-home sales rose about 2.4 percent from April to May thanks to historically low interest rates, home affordability, and the $8,000 first-time home buyer tax credit.

The annual rate of home sales increased to 4.77 million last month from 4.66 million in April, according to NAR statistics. While the uptick in sales is a positive sign for the housing market it is actually a smaller gain than expected, which comes as something of a disappointment.

NAR chief economist and spokesman Lawrence Yun cites bad appraisals as the culprit:

“The increase in sales is less than expected because poor appraisals are stalling transactions. Pending home sales indicated much stronger activity, but some contracts are falling through from faulty valuations that keep buyers from getting a loan.”

Yun warned the problem could worsen to the point that it hinders a housing recovery:

“In the past month, stories of appraisal problems have been snowballing from across the country with many contracts falling through at the last moment. There is danger of a delayed housing market recovery and a further rise in foreclosures if the appraisal problems are not quickly corrected.”

In addition to stemming the spread of bad appraisals, NAR is pushing for an expansion of the $8,000 tax credit to all primary home buyers and an extension to 2010 (it is currently scheduled to expire this November 30th).

NAR also reported that the amount of distressed properties as a percentage of overall home sales shrank considerably, from 45 percent in April to 33 percent in May. Yun attributed this to increased activity from repeat buyers, who typically have more money to spend than first-time buyers and are therefore less inclined to buy distressed properties.

At the end of May the national housing inventory stood at 3.80 million, which would take 9.6 months to absorb at the current sales pace. Recall that 5 to 6 months of inventory is considered a normal market, while 7 months and above is considered a buyer’s market.

The national median home price for May was $173,000. The NAR cautions that this figure is “distorted” by sales of distressed properties, which are sold at a discount and pull down aggregate price values.

See other articles related to: mcwilliamsballard

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/may_home_sales_were_up_but_appraisal_problem_clouds_outlook/1061.

Most Popular... This Week • Last 30 Days • Ever

The mortgage interest deduction allows homeowners who itemize their taxes to reduce t... read »

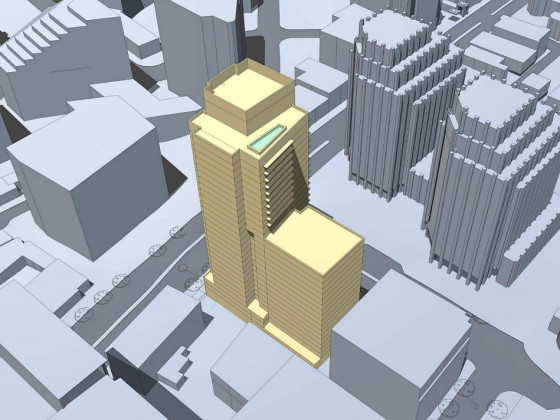

Georgetown is one of the busiest neighborhoods for development in the city.... read »

The large-scale residential development will head to before the Montgomery County Dev... read »

Leading the way is the 20015 zip code where almost half of homeowners are considered ... read »

Georgetown hotel secures financing; Trump releases rendering of east wing ballroom; a... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro