What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

A Deluge of Demand: How Lenders Are Dealing With Record-Low Rates

A Deluge of Demand: How Lenders Are Dealing With Record-Low Rates

✉️ Want to forward this article? Click here.

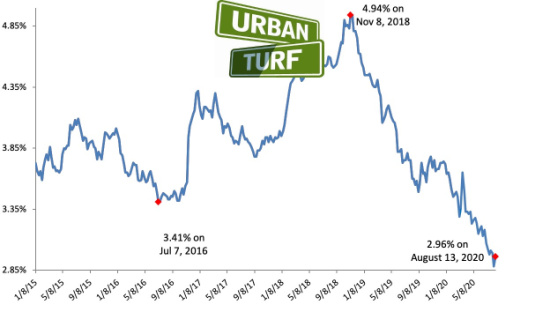

This year's housing market started off in a whirlwind fashion, riding the wave of extra-low mortgage rates until Freddie Mac temporarily raised rates to slow demand. Since March, however, mortgage rates have been set at increasingly lower, record-setting points, and pandemic aside, home buyers and owners have been taking advantage to the point where the DC-area housing market is making records of its own.

Consequently, the mortgage lending industry has seen what Truist senior advisor Steve Abelman describes as a "tidal wave of business" for both new loans and refinancing applications.

"It's busier than I've ever seen it for people looking to refinance their loans," Abelman shares, adding that the lender is regularly above its maximum daily capacity for loan applications.

Patrick Gardner, principal at Vellum Mortgage, has also observed how the high demand is straining lenders' processing departments.

"Industrywide, this has created capacity and labor constraints at a level I haven’t seen before."

story continues below

loading...story continues above

With the onslaught of interest, lenders are being more deliberate in managing expectations; for example, while a refinancing application used to take 45-60 days to process two to three months ago, now Truist is telling clients that the refinance will be complete within 75 days and their rate will be locked in for 90 days.

Sandy Spring Bank is taking a similar approach to its regular mortgage applications.

"You just need to communicate with the client that it's going to take 60 days to complete given how busy everyone is," vice president Joe Zamoiski told UrbanTurf.

Lenders are also recommending that homebuyers be more prudent with their approach. Zamoiski, for example, is telling clients to get a commitment letter from lenders rather than a pre-approval letter to help expedite the process. Abelman is telling clients to shop around, as some lenders are raising their underwriting standards to require a 20-30% down payment in order to quell demand.

But in some ways, the housing market is keeping demand in check simply due to a lack of supply.

"There is not enough housing to meet demand, so the end result is multiple offers, escalation clauses, and an extremely competitive environment," Zamoiski explains. EagleBank vice president Mehdi Pirzadeh has also noticed a frenzied level of activity. "Home sales have not slowed down as they usually do in the summer."

As for refinancing, demand may pick up in the short term on the heels of the announcement that Fannie Mae and Freddie Mac are raising their refinance fees next month. Gardner noted that news of the rise in refi fees also raised some eyebrows. "There is ongoing dialogue on the full fallout here, but at its most basic, expect refinances to cost half a point more ($2,000 on a $400,000 loan)."

Refinancing aside, although mortgage rates went up a tick this past week, they are expected to remain around near historic lows at least through the November election, and perhaps over the next year. It's hard to tell, though.

"Many historical indicators can’t be utilized to predict market movement due to COVID uncertainty, stimulus bills, and political posturing," Gardner explained. "Any shift in strategy here can have a significant economic impact which would trickle down to interest rates – good or bad."

Some quotes in this article were edited for punctuation.

See other articles related to: lending, mortage refinance, mortgage lending, mortgage rates, mortgages, refinancing

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/how-lenders-are-dealing-with-deluge-of-demand-from-record-low-interest-rate/17190.

Most Popular... This Week • Last 30 Days • Ever

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A report out today finds early signs that the spring could be a busy market.... read »

A potential collapse on 14th Street; Zuckerberg pays big in Florida; and how the mark... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro