DC Can't Afford to Increase the Homestead Deduction

DC Can't Afford to Increase the Homestead Deduction

✉️ Want to forward this article? Click here.

In January, Ward 4 Councilmember Brandon Todd introduced a bill that would increase the limit of the homestead exemption in DC. The deduction works by reducing the tax assessment value of a given property. The Homestead Exemption Increase Amendment Act of 2019 would increase the exemption from $74,850 to $125,000 for single-family homes and residential co-ops.

However, while the bill is under review by the Committee on Finance and Revenue, the Chief Financial Officer (CFO) has submitted a Fiscal Impact Statement (FIS) that doesn't bode well for the bill's passage.

story continues below

loading...story continues above

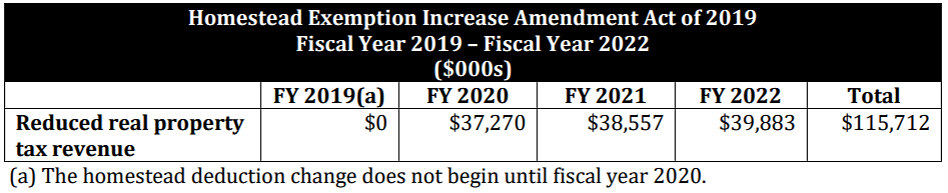

"Funds are not sufficient in the fiscal year 2019 through fiscal year 2022 budget and financial plan to implement the bill," the statement begins. "The bill will reduce real property tax revenues by $37.2 million beginning in fiscal year 2020 and $115 million over the four-year financial plan."

Interestingly, last July, a nearly identical bill was introduced or co-sponsored by every councilmember except for Chair Phil Mendelson and At-Large councilmembers Anita Bonds, Elissa Silverman, Robert White. It doesn't appear that the office of the CFO submitted an FIS at the time, although the assistant general counsel of the Office of Tax and Revenue recommended minor amendments to the bill pertaining to timing and calculation of cost-of-living adjustments.

In the bill's current iteration, the deduction would be effective as of October 1, 2019, and would be adjusted for cost-of-living annually starting October 1, 2020.

See other articles related to: cfo, dc council, homestead deduction, property taxes, taxes

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/cfo-dc-cant-afford-to-increase-the-homestead-deduction/15027.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro