What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

A $500,000 Refinance Scenario

A $500,000 Refinance Scenario

✉️ Want to forward this article? Click here.

With long-term interest rates dipping below 4 percent last week, many homeowners are likely thinking about refinancing their home mortgages.

So, how do you know when to pull the trigger? Some believe that a good measuring stick is to wait until mortgage rates have dropped 1 percent below the rate you locked in when you bought your home; others urge owners to balance the cost of refinancing with how much they will save every month at the new rate.

Another factor that plays into whether or not you should refinance is how long you plan to live in the home. If a borrower divides the costs associated with refinancing by the amount they will save on their mortgage every month, the calculated figure will be the number of months that it takes to break even. If you plan on being in your house longer than that, refinancing might make sense.

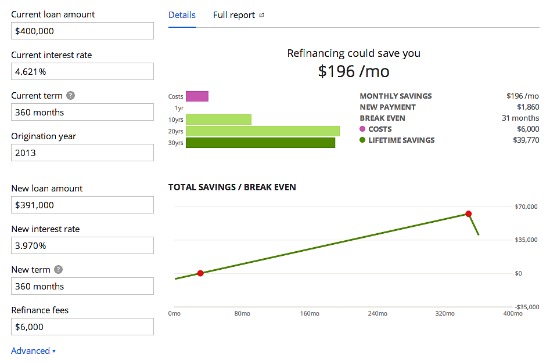

With the latter point in mind, we set up a refinancing scenario based on a $500,000 home purchase. For our purposes, the home was purchased with a 20 percent down payment back in August 2013 when rates stood at 4.58 percent. The refinancing would be done at last week’s rate of 3.97 percent and cost the borrower $6,000.

Using Zillow’s Refinance Calculator here is how things would look:

In short, the savings would amount to $196 a month and the borrower would break even on the refinancing costs after 31 months. So, it really would only make sense to pony up the $6,000 in refinancing fees if you plan to stay in your house for at least three years.

To try out your own refinancing scenario, click here.

See other articles related to: refinancing

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/a_500000_refinance_scenario/9120.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro