What Homeowners Should Do Before The End of the Year

What Homeowners Should Do Before The End of the Year

✉️ Want to forward this article? Click here.

As the year draws to a close, homeowners have the opportunity to maximize their tax benefits and take advantage of various deductions and credits. Here are several tax-related tasks that homeowners should consider before 2024 comes to a close:

story continues below

loading...story continues above

-

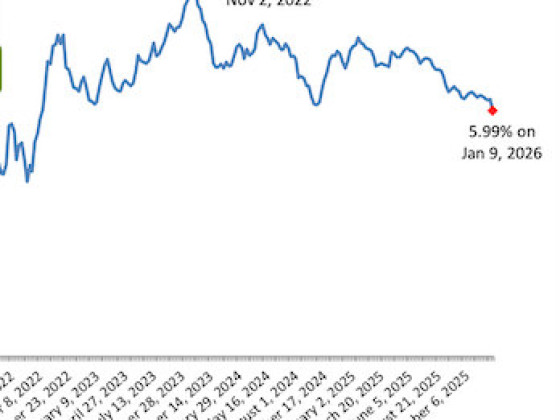

Mortgage Interest Deduction: Homeowners can deduct the interest paid on their mortgage loans, which is a significant tax benefit. To maximize this deduction, make an additional mortgage payment before the year ends to increase the interest portion of your payment.

-

Property Tax Deduction: Homeowners can deduct property taxes paid during the tax year. Check your records or contact the tax assessor's office to ensure you have paid all applicable property taxes for the year.

-

Energy-Efficient Home Improvements: Installing energy-efficient improvements such as solar panels, energy-efficient windows, or insulation may qualify for tax credits. Take advantage of these credits by completing eligible upgrades before the year concludes.

-

Home Office Deduction: If you use part of your home exclusively for business purposes, you might qualify for a home office deduction. Keep records of the square footage of your home office and related expenses.

-

Capital Gains Exclusion: If you sold your primary residence during the year, you might be eligible for a capital gains exclusion. Generally, if you've lived in the house for at least two of the past five years, up to $250,000 of capital gains ($500,000 for married couples filing jointly) may be excluded from your taxable income.

-

Home Equity Loan Interest Deduction: In some cases, the interest paid on a home equity loan or line of credit may be deductible. Review the terms of your loan and consult a tax professional to determine if this applies to your situation.

-

Keep Records and Receipts: Ensure you have accurate records and receipts for all home-related expenses and improvements made throughout the year. These documents are crucial for claiming deductions or credits and can help in case of an IRS audit.

-

Prepaid Expenses: Consider prepaying deductible expenses such as mortgage interest or property taxes before the year ends to increase your deductions for the current tax year.

By taking these steps, homeowners can potentially lower their tax burden and make the most of available deductions and credits. However, it's important to consult a tax professional for personalized advice based on your individual circumstances.

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/what_homeowners_should_do_before_the_end_of_the_year/21770.

Most Popular... This Week • Last 30 Days • Ever

The differences between condo fees and co-op fees might seem small, but there are som... read »

The Wall Street Journal reported the news on Thursday afternoon.... read »

Architecture firm Torti Gallas has been picked to conduct a land use and market study... read »

The Washington Commanders and global architecture and design firm HKS have unveiled t... read »

Rift Valley Partners' proposal will include a 177-unit building consisting of afforda... read »

- What Are the Differences Between Condo Fees and Co-op Fees?

- Washington Commanders Owner Purchases Georgetown's Halcyon House For $28 Million

- A New Plan For The H Street Corridor

- A First Look At The Concept For Washington Commanders Stadium

- DC Picks Team To Redevelop Chevy Chase Library And Community Center

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro