Trulia: Buying 34% Cheaper than Renting in DC Area

Trulia: Buying 34% Cheaper than Renting in DC Area

✉️ Want to forward this article? Click here.

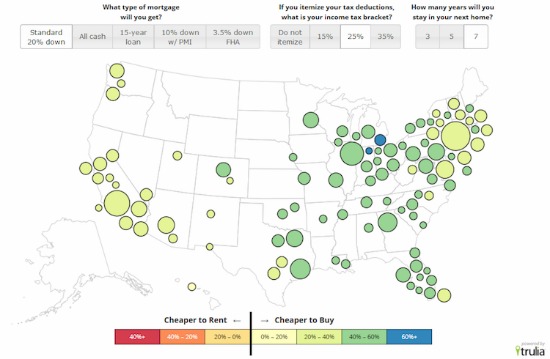

Buying a home remains cheaper than renting in the DC region, according to an analysis from Trulia released on Wednesday.

Specifically buying a home is 34 percent cheaper than renting, according to the company’s analysis, a percentage unchanged since early in 2014. Nationwide, it’s on average 38 percent cheaper to buy than to rent.

Trulia’s chief economist Jed Kolko provided UrbanTurf more fine-grained data that shows how the payoff from buying over renting can vary depending on where in the DC area you live:

Fairfax, VA: 25% cheaper

Loudoun, VA: 26% cheaper

Arlington and Alexandria, VA: 30% cheaper

District of Columbia: 33% cheaper

Montgomery County, MD: 34% cheaper

Prince William, VA: 35% cheaper

Prince George’s, MD: 57% cheaper

As we have reported when covering this analysis in the past, it is important to understand the criteria that Trulia uses when determining if it is cheaper to buy than rent in a metropolitan area.

The company calculates the figures assuming a 20 percent down payment on a 30-year, fixed-rate mortgage financed with a 4.3 percent interest rate. It assumes people itemize their federal tax deductions and are in the 25 percent tax bracket, and factors in renovation and maintenance costs, as well as insurance, utilities, and property taxes at the average metro property tax rate. For renters, the company tacks on renters’ insurance.

Perhaps most significant in the calculations is that Trulia assumes that a homeowner will live in the home for at least seven years.

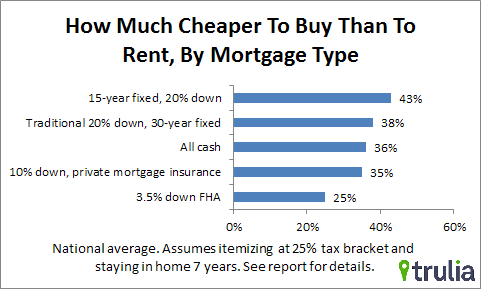

The company’s rent vs. buy calculator can factor in alternative financing, including different types of mortgages and down payment amounts. Trulia ran calculations on different financing options and found that nationwide, buying was cheaper than renting every time.

Trulia notes that seven years may be a long time to stay in one place, especially in a pricey market. Despite the cost differences, buying may not be for everyone:

If you live in a market that’s a close call, and you plan to stay less than seven years, don’t itemize your tax deductions, or need an FHA loan, buying might not be the clear-cut winner. Indeed, if many or all of these things apply to you, buying could end up costing far more than renting. Buying may be 38% cheaper than renting nationally, but there are still plenty of people for whom renting would cost less than buying, even if low down payment loans give them the option to buy.

See other articles related to: buying versus renting, dc buyer, jed kolko, trulia, trulia trends

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/trulia_buying_still_a_lot_cheaper_than_renting_in_dc/9098.

Most Popular... This Week • Last 30 Days • Ever

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The plans for a building that (forgive us) is just trying to fit in in downtown Bethe... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Narrow 260-Unit Apartment Building Pitched For Bethesda Moves Forward

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro