The Pros And Cons Of A 50-Year Mortgage

The Pros And Cons Of A 50-Year Mortgage

✉️ Want to forward this article? Click here.

The idea of a 50-year mortgage is generating plenty of buzz — and debate — in housing and policy circles.

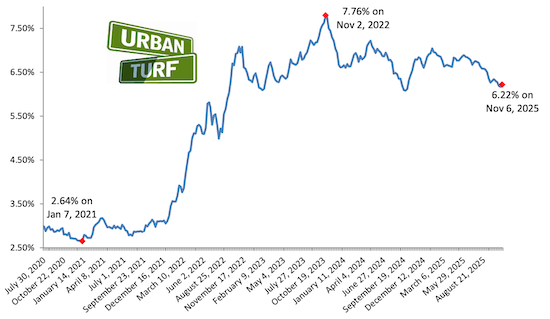

Floated recently by Donald Trump as a way to make homeownership more attainable, the proposal would stretch the standard 30-year mortgage out by two decades. The logic is that the longer loan terms would mean lower monthly payments, allowing more buyers to qualify for homes in a market where affordability has been crushed by high interest rates and record prices.

On paper, the numbers do offer some relief. Extending a loan to 50 years could shave hundreds of dollars off a monthly payment compared to a traditional 30-year term, depending on the home price and interest rate. That lower monthly cost could make a major difference for households in high-cost regions like the DC area, where the median home price now tops $600,000. For some buyers, particularly those with steady income but little savings, the 50-year option could mean the difference between renting indefinitely and owning a home.

But critics say the plan comes with major long-term tradeoffs. Stretching a mortgage to 50 years dramatically increases the total interest paid over the life of the loan — in some cases, nearly doubling it. It also slows down the rate at which homeowners build equity, meaning owners could spend decades with little ownership stake in their property. Housing economists warn that the proposal does little to address the underlying causes of affordability — namely, a shortage of homes for sale and rising construction costs. By making it easier for buyers to qualify, they argue, the program could actually fuel further price increases unless paired with aggressive efforts to expand housing supply.

In short, the 50-year mortgage may offer short-term relief for affordability but long-term challenges for financial stability and wealth building. For markets like DC, where first-time buyers are getting older and prices continue to outpace incomes, the appeal is understandable. Still, experts caution that without broader housing reforms — including zoning changes, faster permitting, and more investment in new construction — extending the mortgage clock another 20 years may only delay, rather than solve, the affordability crisis.

See other articles related to: mortgage rate, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/the_pros_and_cons_of_a_50-year_mortgage/24059.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro