BB&T's CHIP Loan -- The FHA Alternative

BB&T's CHIP Loan -- The FHA Alternative

✉️ Want to forward this article? Click here.

BB&T’s Community Homeownership Incentive Program, better known as CHIP, is one of the best alternatives to FHA financing available on the market today.

In short, CHIP offers qualifying home buyers up to 100% financing with no private mortgage insurance, in stable and increasing value markets. The lack of private mortgage insurance means that the monthly payments on a CHIP loan are often lower than those on competing FHA loans.

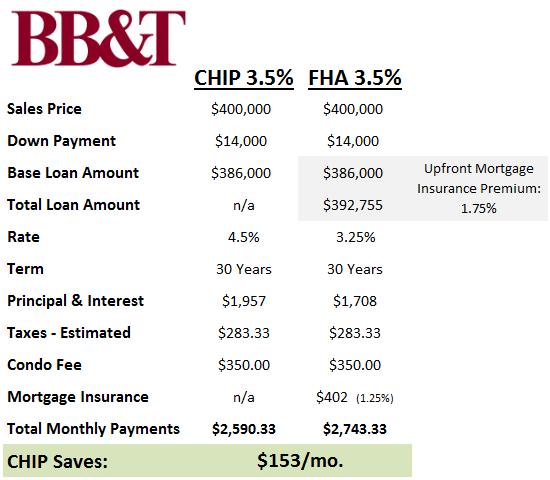

Here is a side-by-side comparison of how CHIP monthly loan payments compare to FHA payments on a $400,000 condo purchase with 3.5% down:

CHIP versus FHA

Here is a quick rundown of specifics and eligibility qualifications for CHIP provided by BB&T mortgage loan officer Kevin Connelly:

- Borrowers who use CHIP can receive loan amounts up to $417,000.

- Borrowers with a combined household income up to $84,000 can take advantage of 100% financing.

- All CHIP loans are 30-year fixed. The base interest rates for condos are currently around 4.5% and 4.375% for single-family homes and row houses.

- All borrowers must contribute at least $500 toward the loan and have financial reserves to cover two-month PITI (principal, interest, taxes, and insurance).

- Owner occupancy is required on the home being purchased.

- The home appraisal has to come back saying that the market where the property is located is stable. DC, Arlington, Alexandria, Prince George's, Prince William and Loudoun Counties are all considered stable, so borrowers across the DC metropolitan area can qualify for 100% financing.

- Condos must be in buildings that are at least 51% owner occupied and no more than 15% delinquent on unit owner condo fees.

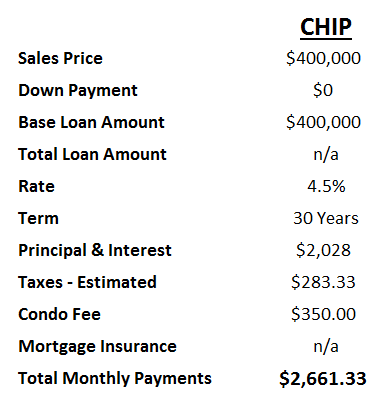

Below is a breakdown on a $400,000 condo purchase using 100% CHIP financing:

$400K condo purchase using CHIP's 100% financing

For more information about the Community Homeownership Incentive Program in the DC area, click here or contact Kevin Connelly at 703-855-7403 or via email at KConnelly@BBandT.com.

See other articles related to: bb&t, sponsored articles

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/sponsored_bbts_chip_loan_the_fha_alternative/3461.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

This article will delve into how online home valuation calculators work and what algo... read »

Navy Yard is one of the busiest development neighborhoods in DC.... read »

Carr Properties' planned conversion of a vacant nine-story office building into a 314... read »

While the national housing market continues to shift in favor of buyers, the DC regio... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro