What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Small Mortgage Rate Drop Compels Uptick in Refinancing

Small Mortgage Rate Drop Compels Uptick in Refinancing

✉️ Want to forward this article? Click here.

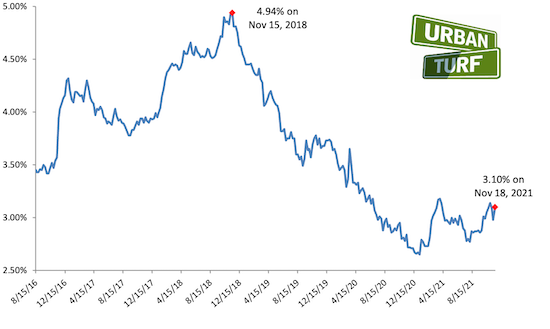

Mortgage rates went down by one basis point last week, and it seems homeowners took notice.

Refinancing applications last week shot up 9% from the week prior, according to the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey and Refinance Index. This is still a 37% drop from the same week a year ago, however.

"Mortgage rates declined for the first time in a month, prompting a pickup in refinancing, with government refinances increasing more than 20 percent over the week," Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting, said in a statement. "While the 30-year fixed mortgage rate and 15-year fixed mortgage rate both declined only one basis point, the FHA rate fell 7 basis points, driving the surge in government refinances."

MBA's weekly survey covers more than 75% of all residential mortgage applications nationwide.

See other articles related to: mortgage rates, refinancing

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/slight-mortgage-rate-drop-compelled-uptick-in-refinancing-applications/19034.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro