Small Mortgage Rate Drop Compels Uptick in Refinancing

Small Mortgage Rate Drop Compels Uptick in Refinancing

✉️ Want to forward this article? Click here.

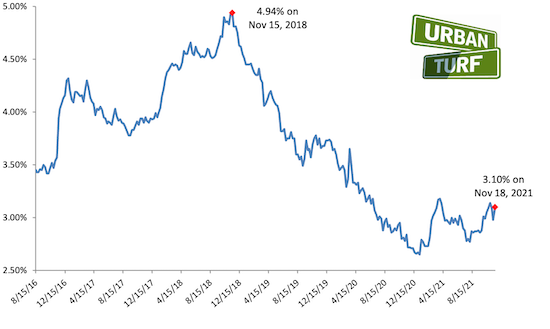

Mortgage rates went down by one basis point last week, and it seems homeowners took notice.

Refinancing applications last week shot up 9% from the week prior, according to the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey and Refinance Index. This is still a 37% drop from the same week a year ago, however.

"Mortgage rates declined for the first time in a month, prompting a pickup in refinancing, with government refinances increasing more than 20 percent over the week," Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting, said in a statement. "While the 30-year fixed mortgage rate and 15-year fixed mortgage rate both declined only one basis point, the FHA rate fell 7 basis points, driving the surge in government refinances."

MBA's weekly survey covers more than 75% of all residential mortgage applications nationwide.

See other articles related to: mortgage rates, refinancing

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/slight-mortgage-rate-drop-compelled-uptick-in-refinancing-applications/19034.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf takes a look at the distinct differences between these two popular f... read »

Buffett called the five-bedroom listing home when his father, Howard Buffett, was ser... read »

Monument Realty has filed updated plans with Arlington County to redevelop the former... read »

What Republican control could mean for DC; the Post wants people back in the office; ... read »

The sale of the 9,100 square-foot residence in Chevy Chase closed in October.... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro