Rents Rise in Columbia Heights, Drop in Silver Spring, Upper NW

Rents Rise in Columbia Heights, Drop in Silver Spring, Upper NW

✉️ Want to forward this article? Click here.

443 Eye Street

Two years ago, the vacancy rate for new apartments in DC was so low that it was hard to imagine when supply would ever get back in line with demand.

Well, over the last 6 to 8 months, the market has been filled with a number of new projects, which are putting downward pressure on rents.

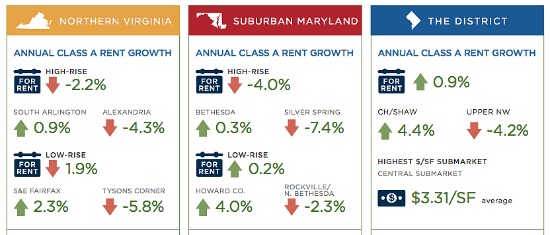

A third quarter report out late Thursday from Delta Associates analyzing the regional Class A apartment market (large buildings built after 1991, with full amenity packages) states that rates for new leases in this sector dropped by 1.1 percent over the last year.

This isn’t to say that rents have dropped everywhere. In the Columbia Heights/Shaw (+4.4%), South Arlington (+0.9%) and Bethesda (+0.3%) sub-markets, rents have actually risen at new buildings. However, they have dropped in sub-markets including Upper NW (-4.2 percent), Alexandria (-4.3 percent) and Silver Spring (-7.4%).

To give these percentages some real meaning, Class A apartments in the Upper NW sub-market now rent for $2,622 a month on average compared to $2,798 last year; in Silver Spring, apartments rent for $1,900 currently versus $2,051 in the third quarter of 2012. (The rents are a weighted average of new studios, one-bedrooms and two-bedrooms in the city.)

Here is a quick snapshot of average rents for Class A apartments in DC area sub-markets, as defined by Delta:

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,817 a month

- Upper Northwest: $2,622 a month

- Columbia Heights/Shaw: $2,546 a month

- NoMa/H Street: $2,297 a month

- Capitol Riverfront: $2,236 a month

- Rosslyn-Ballston Corridor: $2,344 a month

- Alexandria: $1,983 a month

- Bethesda: $2,620 a month

Rents for Class A apartments actually declined in nearly two-thirds of the region’s submarkets, according to the report, and this can be attributed to a high level of new supply in many of these areas that will only grow in the coming months and years. The number of apartment units in the pipeline at the end of 2009 stood at 16,606. In the third quarter of 2013, that number had increased to 36,098.

Definitions:

* Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: apartments, delta associates, renting, renting in dc

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/rents_rise_in_columbia_heights_drop_in_silver_spring_upper_nw/7652.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro