Class A Apartment Market in DC Area Remains Stable with Some Signs of Amazon Anticipation

Class A Apartment Market in DC Area Remains Stable with Some Signs of Amazon Anticipation

✉️ Want to forward this article? Click here.

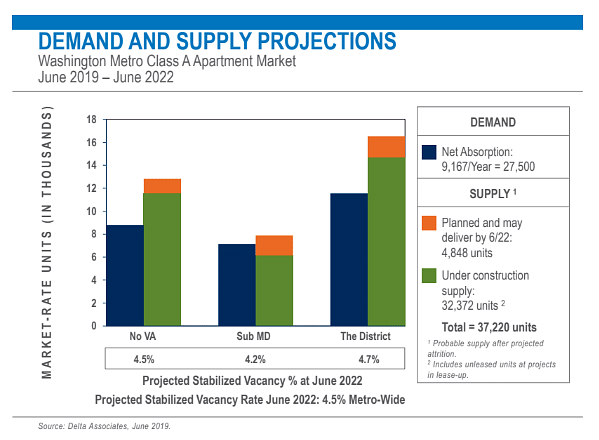

For the fourth consecutive quarter, Class A apartment absorption in the DC region fell short of the 10,000-unit mark for the fourth quarter in a row, although the 9,031 units absorbed in the second quarter of 2019 remain above the long-term average. The 9,100+ mark is expected to be the new normal for the next three years as Amazon draws new renters to the area and increases demand in northern Virginia.

Absorption in northern Virginia rose by 12 percent for the 12-month period ending in the second quarter, despite 23 percent fewer apartments delivering in that period. However, a lot more new apartments are on the horizon.

"Absorption in Northern Virginia is expected to continue to improve in the period ahead as deliveries will increase significantly in the second half of 2019 in Arlington and Alexandria, near Amazon’s new HQ2 campus," the report states.

story continues below

loading...story continues above

The National Landing area is already seeing the first signs of the demand to come, as the Crystal City/Pentagon City area has entered the top three submarkets for absorption in northern Virginia. It doesn't appear that Amazon is the sole source of this demand, however, as the Reston/Herndon area experienced far greater absorption of 924 units over the past year. In fact, the 424 units absorbed in Crystal City and Pentagon City are fewer than those absorbed in the top three submarkets in both DC proper and suburban Maryland.

With over 1,300 units absorbed over the past year, the Capitol Hill/Southwest submarket in DC continues to dwarf the region, preserving the District's position as a region-leader in terms of apartment absorption. Still, overall absorption in DC proper dropped 13 percent over the past year.

Here is a quick snapshot of average rents for high-rise Class A apartments in DC area sub-markets, as defined by Delta:

- Alexandria: $2,187 per month

- Bethesda: $2,767 per month

- Capitol Hill/Capitol Riverfront: $2,600 per month

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,949 per month

- Columbia Heights/Shaw: $2,742 per month

- Crystal City/Pentagon City: $2,532 per month

- NoMa/H Street: $2,440 per month

- Northeast: $2,091 per month

- Rosslyn-Ballston Corridor: $2,561 per month

- Silver Spring/Wheaton: $1,991 per month

- Upper Northwest: $2,825 per month

Note: The rents are an average of studios, one and two-bedroom rental rates at Class A high-rise buildings in the DC area.

Definitions:

Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: absorption rate, amazon hq2, amazon second headquarters, class a apartments, delta associates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/regional-class-a-apartment-market-remains-stable-with-some-signs-of-amazon-/15692.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

On Thursday, the Zoning Commission will consider text amendments aimed at making it e... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- The Decision That Could Lead To More Alley Homes In DC May Be Coming Next Week

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro