New Fulton Bank Community Combo Program Offers Borrowers Up To 100 Percent Financing

New Fulton Bank Community Combo Program Offers Borrowers Up To 100 Percent Financing

✉️ Want to forward this article? Click here.

Fulton Mortgage Company recently announced a new program that will make home ownership more accessible for many in the DC area.

Fulton Mortgage Company recently announced a new program that will make home ownership more accessible for many in the DC area.

The Fulton Bank Community Combo Program offers borrowers an 80 percent first mortgage combined with up to a 20 percent second mortgage, and up to 100 percent financing. This low- or no-down-payment program is an affordable option designed to meet a diverse range of financial and family needs—including homebuyers who have limited funds for a down payment or who face unique circumstances. The program applies to anyone interested in purchasing a primary residence, not just first-time home buyers.

The Fulton Bank Community Combo purchase mortgage offers:

- 80% First Mortgage combined with up to a 20% Second Mortgage* (*matching rate and term for both mortgages)1

- Up to 100 percent financing

- Competitive rates

For qualifying borrowers, no private mortgage insurance (PMI) is required, but homeownership counseling is necessary2. Also, depending on the city and county in which the property is located, income restrictions may apply3.

For more information about the program, contact Noel Shepherd (NMLS #: 313280) at 202.642.4305 or nshepherd@fultonmortgagecompany.com; or visit him online at fultonmortgagecompany.com/noelshepherd.

Fulton Bank NA. Member FDIC. Member of the Fulton Family. Subject to credit approval. 1Financing is based on the lower of either the appraised value (fair market value) or contract sales price. 2Must be provided by a HUD-approved housing counseling agency. Counseling fees are paid by the homeowner and will vary by location. 3Income restrictions apply to borrower's income only, not household income.

Fulton Bank NA. Member FDIC. Member of the Fulton Family. Subject to credit approval. 1Financing is based on the lower of either the appraised value (fair market value) or contract sales price. 2Must be provided by a HUD-approved housing counseling agency. Counseling fees are paid by the homeowner and will vary by location. 3Income restrictions apply to borrower's income only, not household income.

See other articles related to: Fulton Mortgage Company

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/new-fulton-mortgage-program-offers-borrowers-100-percent-financing/17991.

Most Popular... This Week • Last 30 Days • Ever

The mortgage interest deduction allows homeowners who itemize their taxes to reduce t... read »

An incredibly rare opportunity to own an extraordinary Maryland waterfront property, ... read »

Georgetown is one of the busiest neighborhoods for development in the city.... read »

The large-scale residential development will head to before the Montgomery County Dev... read »

Leading the way is the 20015 zip code where almost half of homeowners are considered ... read »

- How Does The Mortgage Interest Deduction Work?

- 28 Acres, 1,500 Feet of Potomac River Waterfront: Sprawling Estate Hits The Market Just South of DC

- Hotels, Heating Plants & Conversions: The 10 Big Projects In The Works In Georgetown

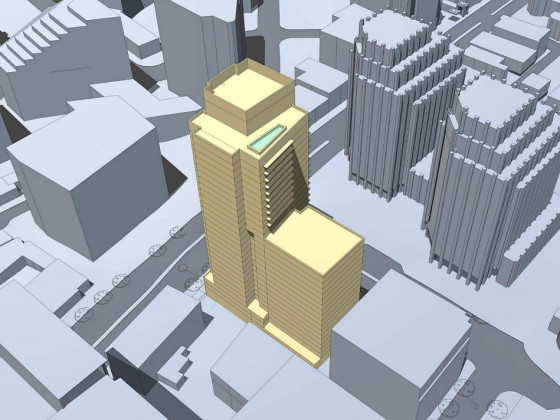

- 29-Story, 420-Unit Development Pitched For Bethesda Moves Forward

- New Report Looks At Where Owners Are House Rich In DC

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro