Most Notable Trends of 2012: Micro-Units, Tight Inventory and Fundrise

Most Notable Trends of 2012: Micro-Units, Tight Inventory and Fundrise

✉️ Want to forward this article? Click here.

2012 was a year when several real estate trends seemed to take over the conversation. Here is a look at three.

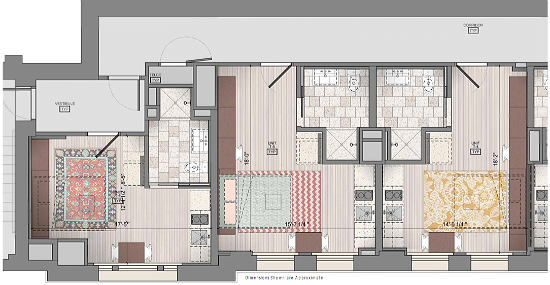

Micro-Units

We’re guilty: UrbanTurf loves writing about micro-units and small homes. From the 275-square-foot units that almost came to Chinatown to the Tiny Houses of Stronghold to the 320-square-foot units coming to Shaw, we know that we have reported on this trend ad nauseaum over the last 12 months. And while detractors derisively call these living quarters “closets”, micro-units may become a reality as rents and home prices continue to go up and young adults continue to want to live near the city core.

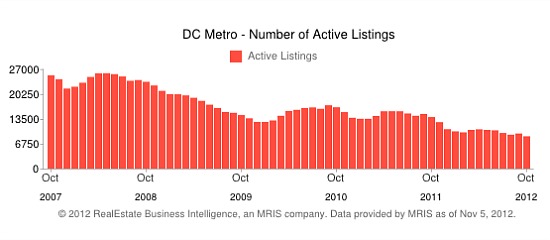

Inventory of active listings in DC area since October 2007.

Tight Inventory

The next trend is one that shaped almost every homebuyer’s experience this year: the low inventory of active listings in the area.

Every month, the RealEstate Business Intelligence (RBI) report seemed to reveal historically low inventory, reaching a seven-year low in July and again in November.

2012 was the year that saw homes flying off the market within days, as evidenced by the numbers in our near-weekly Home Price Watch, and a remarkably low inventory of new condos. As a result, desirable homes regularly received multiple offers and new condo projects would sell out within weeks. This likely added an amount of frustration for buyers, who had to stay on top of new listings and compete perhaps more than in other years. As DC’s population grows by 1,000 new residents per month, we’ll certainly be watching to see if this trend continues in the coming year.

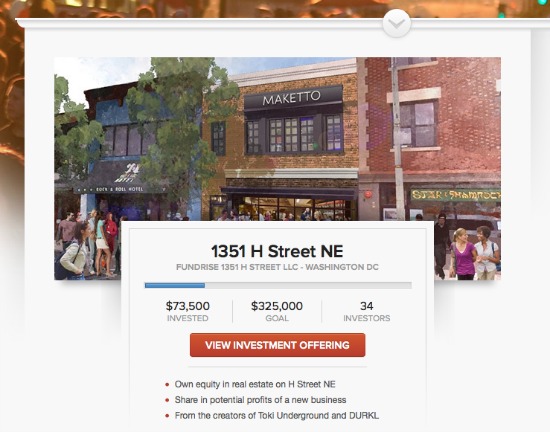

Fundrise’s first project: Maketto

Fundrise

In an early conversation that UrbanTurf had with Rise Companies founder Ben Miller, he hinted that the best way for community members to impact the retail in their neighborhood might be to actually find a way to own the retail. Sure enough, not a month later Miller announced Fundrise, a model that allows community members to buy a share of investment in a retail property, and to potentially share in the profits.

It wasn’t long before everyone from the Washington Post to Atlantic Cities was talking about this new concept. The original Fundrise property raised $325,000 from micro-investors and just closed in November; the company is now gearing up to release more investment options. The idea also seems contagious: one of the developers for Parcel 42 in Shaw proposed a community investment model in their pitch.

Is this concept going to sweep the nation? It’s a gamble: we may not know for years whether or not this sort of investment will yield dividends for those who buy in. But we’ll be sure to keep our eyes on Fundrise as it moves forward.

See other articles related to: best of 2012, dclofts, fundrise, housing inventory, micro units

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/most_notable_trends_of_2012_micro-units_fundrise_and_tight_inventory/6391.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

A significant infill development is taking shape in Arlington, where Caruthers Proper... read »

A new mixed-use development would bring hundreds of new residential units and a healt... read »

A residential conversion in Brookland that will include reimagining a former bowling ... read »

After years of experimenting with its branded brick-and-mortar grocery concepts, Amaz... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro