Mortgage Demand Pops As Rates Drop To Three-Month Lows

Mortgage Demand Pops As Rates Drop To Three-Month Lows

✉️ Want to forward this article? Click here.

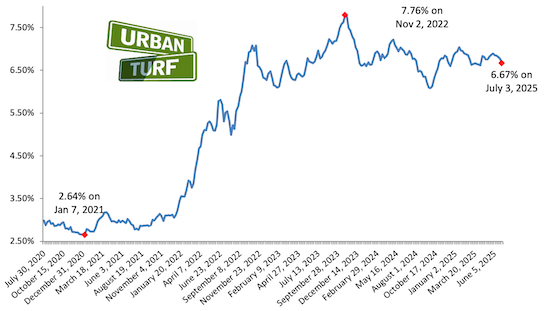

Long-term mortgage rates dropped to their lowest level in three months and homebuyers took notice.

Applications to purchase a home increased 9% week-over-week, and were 25% percent higher than a year ago, according to the Mortgage Bankers Association (MBA) on Wednesday. Applications to refinance also rose 9% for the week and were 56% higher than the same week one year ago.

“Homebuyer demand is being fueled by increasing housing inventory and moderating home-price growth,” said Joel Kan, vice president and deputy chief economist at the MBA, said in a release. “The average loan size on a purchase application, at $432,600, was at its lowest since January 2025.”

See other articles related to: mortgage demand

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/mortgage_demand_pops_as_rates_drop_to_three-month_lows/23664.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The plans for a building that (forgive us) is just trying to fit in in downtown Bethe... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

Even with over 1,100 new apartments delivering in the last 18 months, the new develop... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Narrow 260-Unit Apartment Building Pitched For Bethesda Moves Forward

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

- The Nearly 2,000 Units Still In The Works At Buzzard Point

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro