How I Got $70K for My First Home

How I Got $70K for My First Home

✉️ Want to forward this article? Click here.

Many people have heard about the Home Purchase Assistance Program (HPAP), but few of us know someone who has actually taken advantage of it to buy a house. UrbanTurf recently spoke with Andy Serfass who jumped at the opportunity last summer to get just under $70,000 from the program to put toward the down payment on a two-bedroom home in Northeast.

HPAP is a DC initiative that gives up to $40,000 in financial assistance to low and moderate-income individuals to purchase single-family homes, condominiums and apartments. The assistance comes in the form of a no-interest 40-year loan (with no payments for the first five years). The dollar amount used to max out at $70,000, but effective January 16, 2009 that number was lowered by $30,000.

Andy, a native Washingtonian who works for the Department of the Navy, applied for the program back in August 2008. After he was accepted, he was required to attend a four-hour class that served as an introduction to the program and then another one-day class that covered the process, certain program restrictions and even a tutorial on home maintenance.

“They try really hard to make sure that you don’t walk into a house that is falling apart or one that you don’t know how to repair,” Andy said. “They want it to be in as good shape as possible.”

About a month and a half later, Andy put an offer (in the mid-$200s) on a two-bedroom, 1,600 square-foot house near 7th Street and Florida Avenue NE. The house is about five blocks from the New York Avenue Metro stop on the Red Line, and has a large first floor that is split between the kitchen and living room.

Once the offer was finalized, Andy said the inspections started. HPAP requires the homeowner to get an inspector to come out and look at the house. Once that analysis is complete, the owner must fix all the problems that were found. Finally, HPAP sends out its own inspector, and a second inspection is done.

“Luckily, I didn’t have a very long list of things that needed to be fixed,” Andy told UrbanTurf. “The major thing was the gas line to the furnace had a small leak, and there were a few outlets that weren’t grounded properly.”

However, that was a small bump in the road compared to what came next. In January, HPAP’s budget was cut, and Serfass had yet to get one dollar.

“All it took was about a month for me to qualify for a little bit less than $70,000,” he said. “But then the budget was cut, and I was promised funds that HPAP didn’t have in their account, so I wasn’t sure I was ever going to get the money.”

Serfass had to wait for a “tense” three weeks before he finally got word that he would receive the money. He stressed that you need to be a very patient person to deal with the headaches along the way.

“This is not the program you start once you find your dream house,” he said. “Once you know that you can use the program, go through the process of applying and getting accepted. Then look for the property you want to buy.”

That said, Serfass would go through the whole process again because the deal is just too good to pass up.

For our other article covering HPAP, click here.

See other articles related to: dclofts

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/how_i_got_70k_for_my_first_home/677.

Most Popular... This Week • Last 30 Days • Ever

The differences between condo fees and co-op fees might seem small, but there are som... read »

The Wall Street Journal reported the news on Thursday afternoon.... read »

Architecture firm Torti Gallas has been picked to conduct a land use and market study... read »

The Washington Commanders and global architecture and design firm HKS have unveiled t... read »

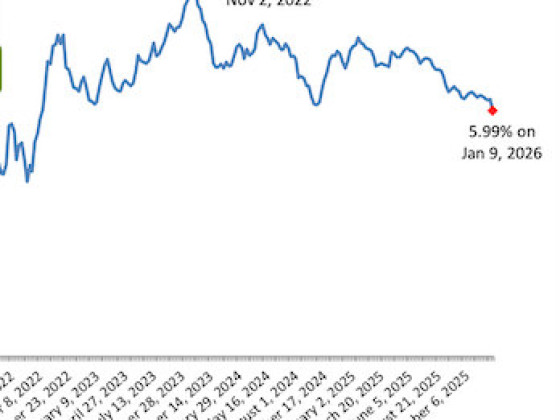

The benchmark rate fell to 5.99%, marking a significant psychological threshold for a... read »

- What Are the Differences Between Condo Fees and Co-op Fees?

- Washington Commanders Owner Purchases Georgetown's Halcyon House For $28 Million

- A New Plan For The H Street Corridor

- A First Look At The Concept For Washington Commanders Stadium

- 30-Year Mortgage Rates Drop Below 6% For First Time In Years

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro