How Does a Mortgage Rate Buydown Work?

How Does a Mortgage Rate Buydown Work?

✉️ Want to forward this article? Click here.

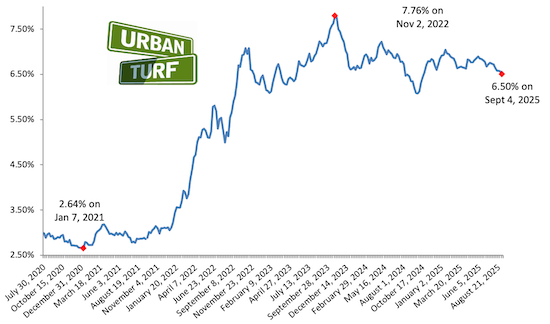

Today, UrbanTurf takes a look at how a mortgage rate buydown works.

A mortgage rate buydown is a strategy used by homebuyers to reduce the interest rate on their mortgage loan. This can be done by paying extra money at closing, which is then used to subsidize the interest rate for a certain period of time.

There are two main types of buydowns: temporary buydowns and permanent buydowns. A temporary buydown involves paying a lump sum when closing on a home to lower the interest rate for the first few years of the loan. A permanent buydown involves paying a larger sum at closing in exchange for a permanently lower interest rate. This can be a good option for buyers who expect to stay in the home for a long period of time and want to save money on interest over the life of the loan.

story continues below

loading...story continues above

One of the most common forms of a temporary buydown is a "two-one buydown." This is where the interest rate is lowered by 2% for the first year, 1% for the second year, and then adjusts to the market rate for the remainder of the loan. This can help the borrower qualify for a loan they otherwise would not have qualified for or afford the monthly payments in the early years of the loan.

The cost of a mortgage rate buydown is typically reflected in the points charged at closing. Points are a percentage of the loan amount, and one point is equal to 1%. For example, if a lender charges two points on a $100,000 loan, the cost of the buydown would be $2,000.

Mortgage rate buydowns can be a good option for buyers who want to save money on interest over the life of the loan or those who expect their income to increase in the future and want to lock in a lower rate.

See other articles related to: interest rates, mortgage rate buydown, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/how_does_a_mortgage_rate_buydown_work/20559.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

A significant infill development is taking shape in Arlington, where Caruthers Proper... read »

A new mixed-use development would bring hundreds of new residential units and a healt... read »

A residential conversion in Brookland that will include reimagining a former bowling ... read »

After years of experimenting with its branded brick-and-mortar grocery concepts, Amaz... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro