What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

How the Class A Apartment Market Has Recovered in the DC Region

How the Class A Apartment Market Has Recovered in the DC Region

✉️ Want to forward this article? Click here.

All signs point to a luxury apartment market in the DC area that has fully recovered from the pandemic.

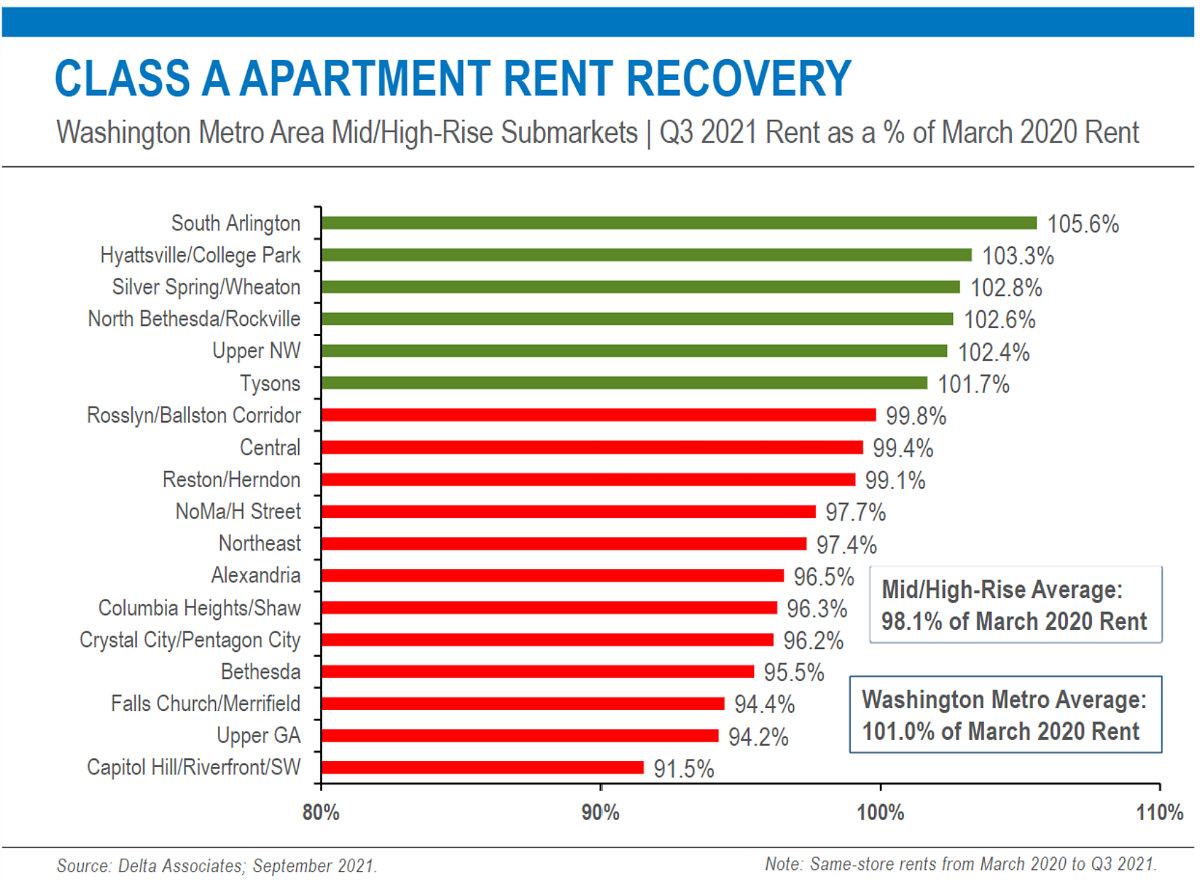

Class A apartment rents in the region are now higher than before the pandemic started, according to a new report from Delta Associates on the third quarter market. This rebound is largely due to the record-high apartment absorption observed over the past year, to the tune of 16,367 units in the area. Rent recovery has been somewhat uneven, however.

story continues below

loading...story continues above

The Suburban Maryland submarket has average rents that are 104% of what they were in March 2020. Similarly, annual absorption increased by 159% year-over-year, compared to a 76% increase seen in Northern Virginia. Average rents in Northern Virginia during the third quarter were 102% of what they were in March 2020.

In DC, however, rents are still below (96.6%) what they were in early 2020. This is despite the fact that annual absorption citywide increased by 201% year-over-year, hitting a record high of more than 7,000 units absorbed.

The Capitol Hill/Capitol Riverfront/Southwest submarket led the metro area in absorption, with 3,690 units leased in the past year. Meanwhile, the NoMa/H Street submarket led the region in apartments delivered, with 2,027 units entering the market since late 2020. Both of these areas account for two-thirds of the city's 15,000-unit 36-month pipeline.

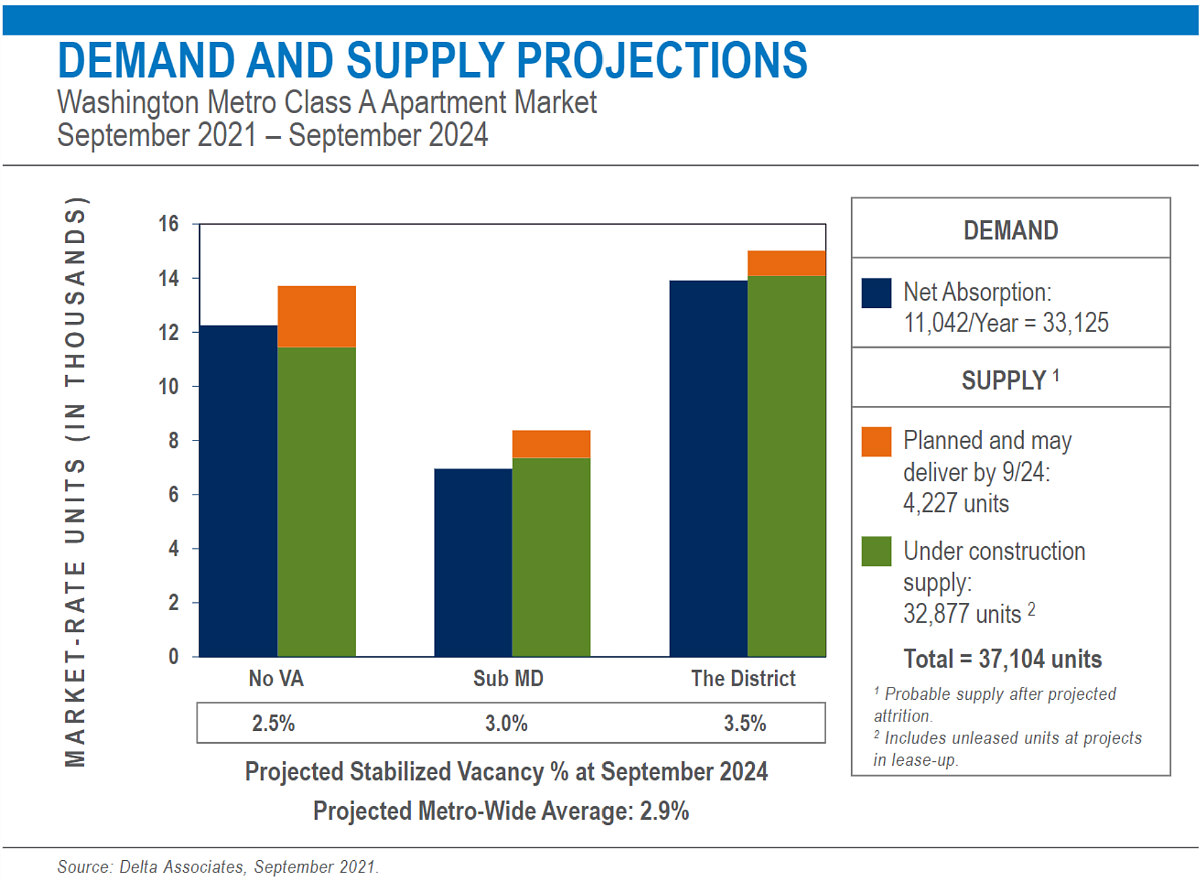

As for the region overall, there are 37,100 apartments in the 36-month pipeline, 4,500 fewer than were in the works a year ago. Nearly 15,000 units are slated to deliver over the next 12 months, 33% more than delivered in the year prior.

Here is a quick snapshot of average rents for high-rise Class A apartments in DC area sub-markets, as defined by Delta:

- Alexandria: $2,154 per month

- Bethesda: $2,762 per month

- Capitol Hill/Capitol Riverfront: $2,516 per month

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,938 per month

- Columbia Heights/Shaw: $2,577 per month

- Crystal City/Pentagon City: $2,450 per month

- Hyattsville/College Park: $1,967 per month

- NoMa/H Street: $2,353 per month

- Northeast: $2,161 per month

- Rosslyn-Ballston Corridor: $2,598 per month

- Silver Spring/Wheaton: $2,039 per month

- Upper Northwest: $2,942 per month

Note: The rents are an average of studios, one and two-bedroom rental rates at Class A high-rise buildings in the DC area.

Definitions:

Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: absorption rate, class a apartments, delta associates, pipeline

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/how-class-a-apartment-market-has-recovered-in-the-dc-area/18869.

Most Popular... This Week • Last 30 Days • Ever

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

A report out today finds early signs that the spring could be a busy market.... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro