What's Hot: The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

Construction Companies Save 17 Percent Through Illegal Worker Misclassification, Per Report

Construction Companies Save 17 Percent Through Illegal Worker Misclassification, Per Report

✉️ Want to forward this article? Click here.

Misclassification of employees as independent contractors is a tale as old as payroll taxes, and the construction industry is no exception. Labor costs are a major facet of the recent ballooning of construction costs nationwide, and now, the District is scrutinizing how construction firms are cutting corners to save on costs.

Yesterday, the city's Office of the Attorney General (OAG) released a report shedding light on how construction companies in DC use worker misclassification to save on labor costs. In general, the responsibilities owed to and expected from independent contractors tend to be less demanding for the employer and less restrictive for the individual than for traditional employees. Some companies illegally classify individuals who work for them as an independent contractor, despite those individuals being treated as an employee, in order to reduce the administrative cost. This also has the effect of shifting administrative costs to the worker and disenfranchising the misclassified worker from access to unemployment, benefits, worker's compensation, overtime and the like.

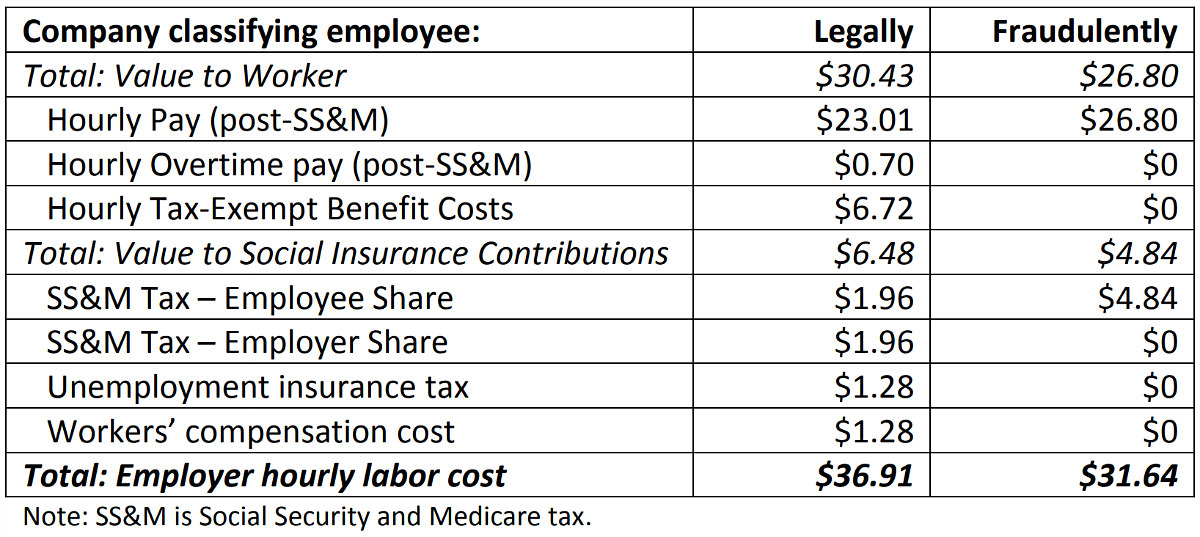

For the construction industry, these illegally-acquired cost savings enable firms to submit more fiscally attractive bids for construction jobs, undercutting competing firms which don't engage in misclassification. The report assumes an average hourly labor cost of $36.91 for legally-classified workers and $31.64 for illegally-classified workers, netting a respective $30.43 or $26.80 in take home wages for the worker, a difference of at least 11.5 percent.

"The cost evasion of illegally misclassifying workers in the District’s construction industry begins at 16.7 percent, which companies can use to underbid and undercut high-road employers," the report states. This means that employers which illegally misclassify workers can expect to save $16.70 per $100 paid in labor costs. Even worse, when factoring in how unlikely it is that the profits from cost evasion are "passed on" to workers in the form of benefits, this cost evasion is closer to 48 percent.

“Companies that illegally misclassify employees as independent contractors are stealing from workers, evading taxes, and gaining an unlawful edge over competitors,” Attorney General Karl Racine said in a statement. “The Office of the Attorney General commissioned this study to better understand the dynamics of worker misclassification and how we can fight it.”

The OAG currently is investigating or pursuing action against some construction companies and contractors, and sued electrical subcontractor Power Design last year for misclassification.

See other articles related to: construction, construction costs, construction industry, employment, oag, office of the attorney general, wage theft

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/construction-companies-save-17-percent-through-illegal-worker-misclassifica/15869.

Most Popular... This Week • Last 30 Days • Ever

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

The plan to replace the longtime home of Dance Loft on 14th Street with a mixed-use ... read »

The plans for a building that (forgive us) is just trying to fit in in downtown Bethe... read »

Even with over 1,100 new apartments delivering in the last 18 months, the new develop... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

- One of DC's Oldest Homes Is Hitting the Market

- Plans For 101 Apartments, New Dance Loft On 14th Street To Be Delayed

- Narrow 260-Unit Apartment Building Pitched For Bethesda Moves Forward

- The Nearly 2,000 Units Still In The Works At Buzzard Point

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro