Co-op Transfer Tax Goes Into Effect October 1

Co-op Transfer Tax Goes Into Effect October 1

✉️ Want to forward this article? Click here.

A couple weeks ago, we reported that the DC City Council passed a measure to tax the sale of co-ops in the District. Yesterday, we learned that the new tax will go into effect this October.

Starting October 1, 2009, co-op sales will be taxed under an economic interest tax, which will be set at 1.1 percent for residential property sales less than $400,000 and at 1.45 percent for sales $400,000 and above. Currently, co-op owners are exempt from these type of recordation and transfer taxes.

The transaction fee will apply to both parties (buyer and seller) in the sale of a co-op unit.

Co-ops have long looked attractive to prospective buyers in DC, specifically because these types of taxes were not imposed. (This is because the sale of a co-op unit is not a transfer in title like most properties, but rather a transfer of an “economic interest.”) However, this change may affect a buyer’s perception of just how good a deal they are getting.

See other articles related to: dclofts

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/co-op_transfer_tax_goes_into_effect_october_1/1050.

Most Popular... This Week • Last 30 Days • Ever

The differences between condo fees and co-op fees might seem small, but there are som... read »

The Wall Street Journal reported the news on Thursday afternoon.... read »

Architecture firm Torti Gallas has been picked to conduct a land use and market study... read »

The Washington Commanders and global architecture and design firm HKS have unveiled t... read »

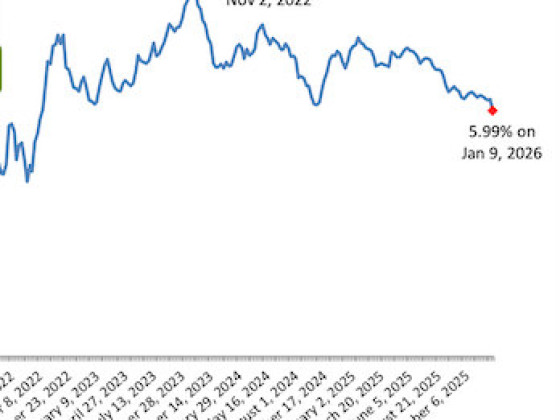

The benchmark rate fell to 5.99%, marking a significant psychological threshold for a... read »

- What Are the Differences Between Condo Fees and Co-op Fees?

- Washington Commanders Owner Purchases Georgetown's Halcyon House For $28 Million

- A New Plan For The H Street Corridor

- A First Look At The Concept For Washington Commanders Stadium

- 30-Year Mortgage Rates Drop Below 6% For First Time In Years

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro