5.9%? 6.4%? A Mortgage Rate Forecast For 2026

5.9%? 6.4%? A Mortgage Rate Forecast For 2026

✉️ Want to forward this article? Click here.

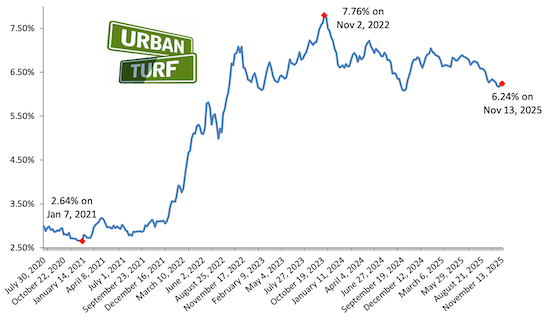

As we round the corner into 2026, predictions for 30-year fixed mortgage rates are showing cautious optimism—yet with ample caveats.

The Fannie Mae Economic & Strategic Research Group projects the average 30-year rate will fall to about 5.9 percent by the end of 2026. That would mark a meaningful drop from where rates have been for a couple years—but it still leaves borrowing costs higher than the ultra-low era of the 2010s.

Even as headline numbers drift lower, many industry watchers caution that the drop won’t be dramatic or uniform. The Mortgage Bankers Association forecasts that, because of pressures like elevated inflation expectations and large federal deficits, long-term mortgage rates may linger in the 6.0 to 6.5% band well into the next few years.

What this means for the housing market is nuanced. A modest drop in rates to the high-5%s could peel back some of the affordability pressures that have kept many potential buyers sidelined. The Fannie Mae outlook estimates mortgage originations rising from $1.85 trillion in 2025 to $2.32 trillion in 2026, reflecting a pickup in activity if borrowing costs ease. But even with that uptick, structural constraints—tight inventory in many markets, high home-price baselines, and elevated payment burdens—mean that any momentum will be incremental.

See other articles related to: mortgage rate forecast, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/59_64_a_mortgage_rate_forecast_for_2026/24106.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

A significant infill development is taking shape in Arlington, where Caruthers Proper... read »

A new mixed-use development would bring hundreds of new residential units and a healt... read »

A residential conversion in Brookland that will include reimagining a former bowling ... read »

After years of experimenting with its branded brick-and-mortar grocery concepts, Amaz... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro