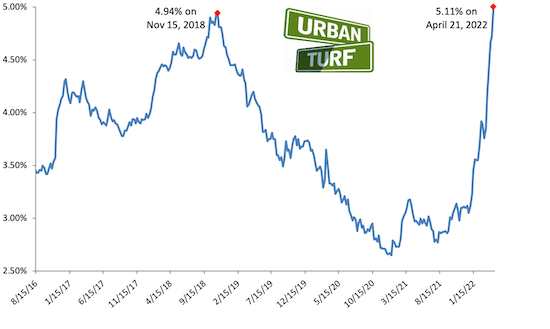

5.11%: Long-Term Mortgage Rates Now Exceed 5%

5.11%: Long-Term Mortgage Rates Now Exceed 5%

✉️ Want to forward this article? Click here.

Last week, long-term mortgage rates hit 5% for the first time in a decade. Today, they went up again.

Freddie Mac reported 5.11% with an average 0.8 point today, up 11 basis points compared to last week. A year ago at this time, rates were averaging just under 3%.

story continues below

loading...story continues above

“Mortgage rates increased for the seventh consecutive week, as Treasury yields continued to rise,” Freddie Mac's Sam Khater said in a statement. “While springtime is typically the busiest homebuying season, the upswing in rates has caused some volatility in demand. It continues to be a seller’s market, but buyers who remain interested in purchasing a home may find that competition has moderately softened.”

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: interest rates, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/511-long-term-mortgage-rates-now-exceed-5/19553.

Most Popular... This Week • Last 30 Days • Ever

A new report shows that asking rents across the DC region saw some of the largest dec... read »

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro