$400 a Month: The Difference Two Months Makes in Interest Rates

$400 a Month: The Difference Two Months Makes in Interest Rates

✉️ Want to forward this article? Click here.

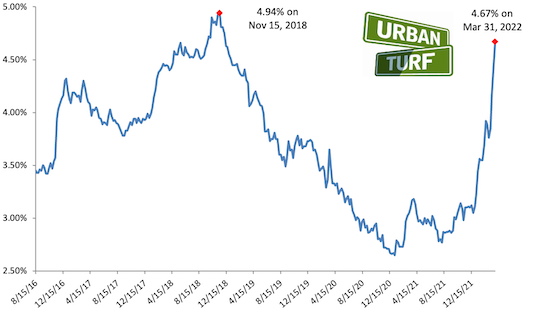

The rise in long-term interest rates over the last several weeks has been historic, with 30-year rates increasing almost 100 basis points during that time.

So today, UrbanTurf is taking a look to see how current rates are impacting mortgage payments compared to just two months ago.

We took a home with an $800,000 purchase price and assumed the buyer has excellent credit. Using the current rates and rates from early February we examined how monthly mortgage payments changed. In each case, we assumed the buyer put down a 20 percent down payment. Note that these include principal and interest, but not the cost of insurance or taxes.

story continues below

loading...story continues above

Here are the two scenarios:

February 2022: The average mortgage rate was 3.55 percent.

Monthly mortgage payment: $2,891

Total outlay on mortgage (monthly payment x 360 months): $1,041,000

April 2022: The average mortgage rate is 4.67 percent.

Monthly mortgage payment: $3,307

Total outlay on mortgage (monthly payment x 360 months): $1,190,000

So, the difference between a rate of 3.55 percent and 4.67 percent is $416 a month or $149,000 over the life of the loan.

See other articles related to: interest rates, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/400-a-month-the-difference-two-months-makes-in-interest-rates/19478.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

The 30,000 square-foot home along the Potomac River sold at auction on Thursday night... read »

A new report shows that asking rents across the DC region saw some of the largest dec... read »

Capital Bikeshare breaks a record; Trump potentially legalizes weed sales in DC; and ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro