4.71%: Mortgage Rates at All-Time Low

4.71%: Mortgage Rates at All-Time Low

✉️ Want to forward this article? Click here.

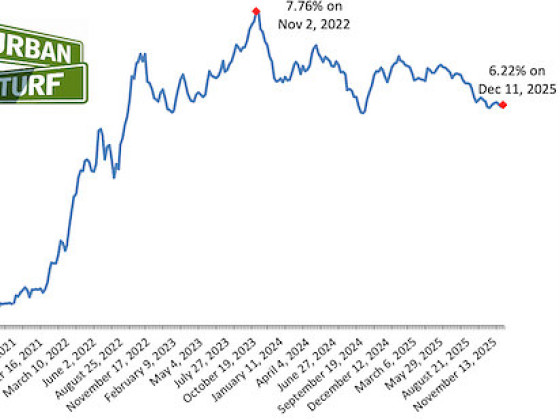

Just before Thanksgiving, Freddie Mac reported that 30-year fixed-rate mortgages dropped to 4.78 percent, tying a record low set back in April. This morning, Freddie Mac reported that rates on 30-year fixed-rate mortgages dropped to 4.71 percent, a new record low for these rates since the mortgage and loan corporation started keeping track in 1970.

From Freddie Mac chief economist Frank Nothaft:

“Interest rates for 30-year and 15-year fixed-rate mortgages fell for the fifth consecutive week to an all-time low while the average rate on five-year (adjustable-rate mortgages) hovered near its record set in the previous week.”

Back in 2007, interest rates were approaching 7 percent, so the difference that two years makes in terms of the money that you can save buying now versus back then is pretty significant. For example, the monthly payments on a $499,000 home (where you put 20 percent down) in 2007 would’ve been $2,656; with today’s rates, the monthly payments would be $2,073, almost a $600 difference.

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/4.71_mortgage_rates_at_all-time_low/1572.

Most Popular... This Week • Last 30 Days • Ever

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

The 30,000 square-foot home along the Potomac River sold at auction on Thursday night... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro