$350 a Month: The Difference a Year Makes in Interest Rates

$350 a Month: The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

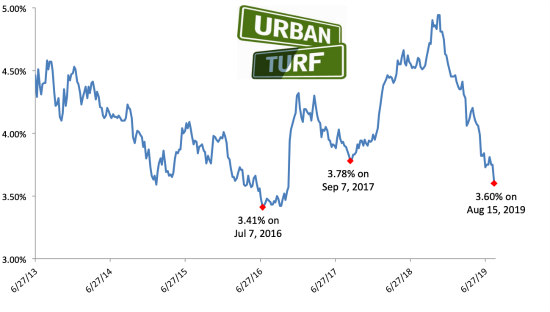

The average on a 30-year fixed-rate mortgage remained at 3.6 percent today, the lowest level for these rates in almost three years.

"The decline in mortgage rates over the last month is causing a spike in refinancing activity – as homeowners currently have $2 trillion in conventional mortgage loans that are in the money – which will help support consumer balance sheets and increase household cash flow," Freddie Mac's Sam Khater said in a statement. "On top of that, purchase demand is up seven percent from a year ago.”

A year ago, long-term rates were almost 100 basis points higher (4.53 percent), so it feels fitting for UrbanTurf to take its semi-regular look to see how changing rates are impacting mortgage payments.

We took a home with a $800,000 purchase price and assumed our buyer has excellent credit. Using the current rates and rates from last year, we examined how monthly mortgage payments changed. In each case, we assumed the buyer put down a 20 percent down payment. Note that these include principal and interest, but not the cost of insurance or taxes.

story continues below

story continues above

Here are the two scenarios:

August 2018: The average mortgage rate was 4.53 percent.

Monthly mortgage payment: $3,254

Total outlay on mortgage (monthly payment x 360 months): $1,171,513

May 2019: The average mortgage rate is 3.60 percent.

Monthly mortgage payment: $2,909

Total outlay on mortgage (monthly payment x 360 months): $1,047,503

So, the difference between a rate of 4.53 percent and 3.60 percent is $345 a month or $124,010 over the life of the loan.

See other articles related to: freddie mac, interest rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/350-a-month-the-difference-a-year-makes-in-interest-rates/15762.

Most Popular... This Week • Last 30 Days • Ever

A new Zillow report finds that home values and rents around the country rose twice as... read »

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

A new Bright MLS dashboard finds that there was an uptick in new listings coming onli... read »

With three new buildings delivering last year and at the beginning of 2025, the new d... read »

Penzance, in partnership with The Baupost Group, has plans in the works for One Rossl... read »

- How Much Home Prices And Rents In The DC Area Have Risen Since The Pandemic

- A Look At The Tax Benefits of Buying a Home Through a Trust

- DOGE Housing Tracker: New Listings Rise In DC Area Over Last Week

- The Nearly 3,000 Units Still In The Works At Buzzard Point

- 850 New Units Along Rosslyn Skyline Look To Move Forward

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro