3.78: Mortgage Rates Hit New Record Low

3.78: Mortgage Rates Hit New Record Low

✉️ Want to forward this article? Click here.

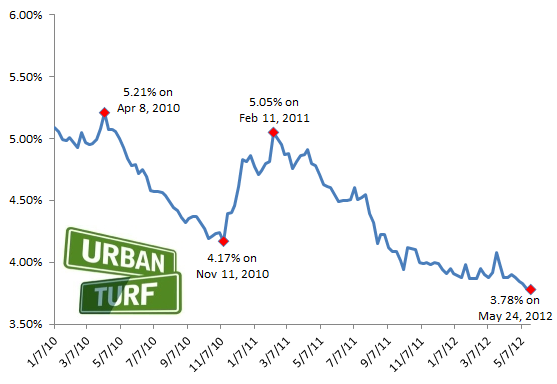

Mortgage rates hit another record low this week.

This morning, Freddie Mac reported 3.78 percent with an average 0.8 point as the average on a 30-year fixed mortgage, down slightly from last week’s 3.79 percent. (The average points rose slightly, so rates may actually be a bit higher.) Rates have been dropping all month: this is the fourth consecutive week that the average on 30-year mortgages has hit or hovered around a new record low.

From Freddie Mac vice president and chief economist Frank Nothaft:

Mortgage rates were virtually unchanged this week with fixed-rate loans remaining at record lows and helping to drive homebuyer affordability. The National Association of Realtor’s Housing Affordability Index reached an all-time record high in the first quarter of this year since records began in 1970. In April, existing home sales rose to the highest rate since January with an annualized rate of 4.62 million homes with purchases increasing in all four Census Regions.

The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate. Still, rates are at historical lows.

Here’s a look at the path of rates since last January:

See other articles related to: freddie mac, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/3.78_mortgage_rates_hoid_near_record_lows/5578.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

This article will delve into how online home valuation calculators work and what algo... read »

Navy Yard is one of the busiest development neighborhoods in DC.... read »

Carr Properties' planned conversion of a vacant nine-story office building into a 314... read »

While the national housing market continues to shift in favor of buyers, the DC regio... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro