January 2015 v. January 2014: The Difference a Year Makes in Interest Rates

January 2015 v. January 2014: The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

Long-term mortgage rates fell for the third straight week as Freddie Mac reported 3.66 percent as the average on a 30-year fixed-rate mortgage on Thursday. Rates were 4.41 percent a year ago.

Freddie Mac’s chief economist Frank Nothaft attributed the drop to falling oil prices and dropping long-term treasury yields, but noted the strength of the economy and the low unemployment rate of 5.6 percent, the lowest since June 2008.

Given the disparity between current rates and rates last January, UrbanTurf decided to take a look at what the difference in monthly mortgage payments would be for someone that purchased a home last year versus someone buying the same house at today’s rates. If you bought a house around this time last year, cover your ears.

To calculate the below, we looked at purchasing a $500,000 house with a 20 percent down payment, with taxes and insurance omitted. For a 30-year fixed-rate mortgage at the average rate, here’s what you’d save:

January 2014: The average mortgage rate was 4.41 percent.

Monthly mortgage payment: $2,206

Total outlay on mortgage (monthly payment x 360 months): $794,160

January 2015: The average mortgage rate is 3.66 percent.

Monthly mortgage payment: $2,015

Total outlay on mortgage (monthly payment x 360 months): $725,400

So, the difference between a rate of 3.66 percent and 4.41 percent is about $191 a month or $68,760 over the life of the loan.

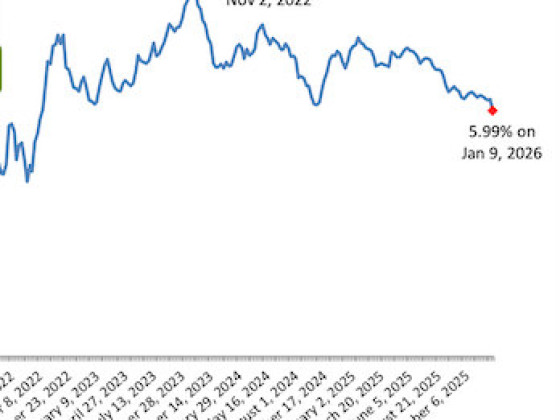

We’re tracking the path of long-term rates since January 2010 in this chart:

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/3.66_percent_mortgage_rates_at_lowest_level_since_may_2013/9410.

Most Popular... This Week • Last 30 Days • Ever

The differences between condo fees and co-op fees might seem small, but there are som... read »

Title insurance is a form of insurance that protects against financial loss from defe... read »

For our first development rundown of the year, UrbanTurf catches up on the latest new... read »

Architecture firm Torti Gallas has been picked to conduct a land use and market study... read »

The benchmark rate fell to 5.99%, marking a significant psychological threshold for a... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro