3.59: Mortgage Rates Drop as Labor Day Approaches

3.59: Mortgage Rates Drop as Labor Day Approaches

✉️ Want to forward this article? Click here.

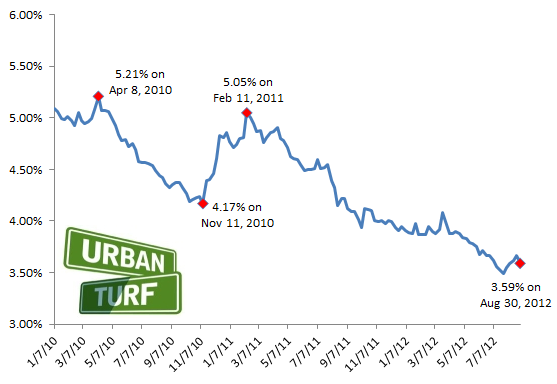

This morning, Freddie Mac reported 3.59 with an average 0.6 point as the average on a 30-year fixed-rate mortgage. The drop comes after long-term rates increased for four straight weeks. In July, rates hit an all-time low of 3.49 percent.

From Freddie Mac vice president and chief economist Frank Nothaft:

Treasury bond yields fell, allowing mortgage rates to follow, after the release of the July 31st and August 1st minutes of the Federal Reserve’s monetary policy committee. Committee members agreed that economic activity had decelerated more in recent months than they had anticipated at their last meeting in June. Some members even saw room for additional stimulus fairly soon if needed.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

Here’s a look at the path of rates since January 2010:

See other articles related to: freddie mac, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/3.59_mortgage_rates_drop_as_labor_day_approaches/5965.

Most Popular... This Week • Last 30 Days • Ever

This article will delve into how online home valuation calculators work and what algo... read »

Navy Yard is one of the busiest development neighborhoods in DC.... read »

On Sunday, Sphere Entertainment Co. announced plans to develop a second U.S. location... read »

Carr Properties' planned conversion of a vacant nine-story office building into a 314... read »

While the national housing market continues to shift in favor of buyers, the DC regio... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro