3.42: Mortgage Rates Reverse Course, Head North

3.42: Mortgage Rates Reverse Course, Head North

✉️ Want to forward this article? Click here.

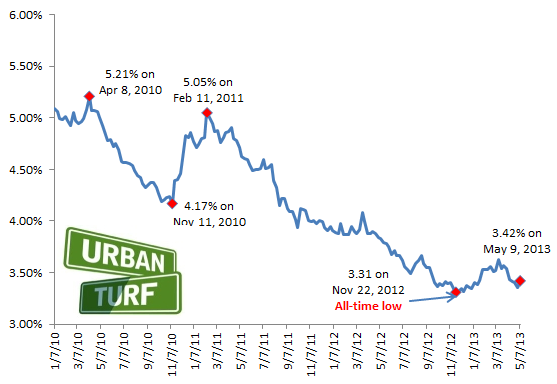

For the first time in six weeks, mortgage rates are moving up.

On Thursday morning, Freddie Mac reported 3.42 percent with an average 0.7 point as the average on a 30-year fixed-rate mortgage. Last week, rates were averaging 3.35 percent, close to the historic low of 3.31 percent.

From Freddie Mac vice president and chief economist Frank Nothaft:

Fixed mortgage rates edged up following a solid employment report for April. The economy gained 165,000 new jobs on net last month, more than the market consensus forecast and the largest monthly increase this year. On top of that, revisions added 114,000 more jobs to February and March as well. All of these factors allowed the unemployment rate to fall to 7.5 percent in April, the lowest since December 2008.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

Here’s a look at the path of rates since January 2010:

See other articles related to: freddie mac, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/3.42_rates_reverse_course_moving_up/7045.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

A significant infill development is taking shape in Arlington, where Caruthers Proper... read »

A new mixed-use development would bring hundreds of new residential units and a healt... read »

A residential conversion in Brookland that will include reimagining a former bowling ... read »

After years of experimenting with its branded brick-and-mortar grocery concepts, Amaz... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro