$257 a Month: The Difference a Year Makes in Interest Rates

$257 a Month: The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

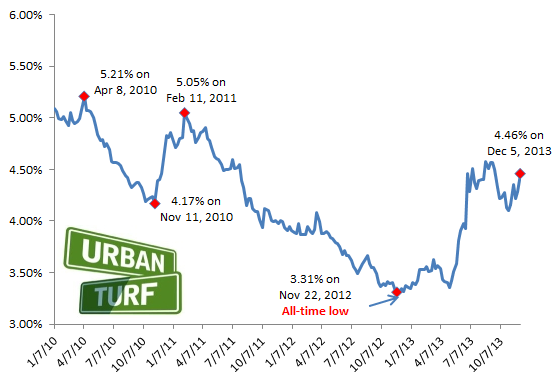

One year ago, the average on a 30-year fixed-rate mortgage was 3.34 percent. On Thursday morning, Freddie Mac reported 4.46 with an average 0.5 point as the average on this type of loan. So, how would the difference impact your mortgage payments?

Using a $500,000 home, we took a look at the difference in monthly payments, based on the today’s interest rates as compared to last year’s.

Let’s assume that in each case, the homeowner puts down 20 percent and takes out a loan for the remaining $400,000.

Here are the two interest rate scenarios.

December 2012: The average mortgage rate was 3.34 percent.

Monthly Mortgage Payment: $1,760

Total Outlay on Mortgage (Payment x 360 months): $633,600

August 2013: The average mortgage rate is 4.46 percent.

Monthly Mortgage Payment: $2,017

Total Outlay (Payment x 360 months): $726,120

So, the difference between a rate of 3.34 percent and 4.46 percent is about $257 a month or $92,520 over the life of the loan.

Here’s a look at the path of rates since January 2010:

See other articles related to: mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/257_a_month_the_difference_a_year_makes_in_interest_rates/7895.

Most Popular... This Week • Last 30 Days • Ever

This article will delve into how online home valuation calculators work and what algo... read »

On Sunday, Sphere Entertainment Co. announced plans to develop a second U.S. location... read »

Carr Properties' planned conversion of a vacant nine-story office building into a 314... read »

Navy Yard is one of the busiest development neighborhoods in DC.... read »

While the national housing market continues to shift in favor of buyers, the DC regio... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro