$197 a Month: The Difference a Year Makes in Interest Rates

$197 a Month: The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

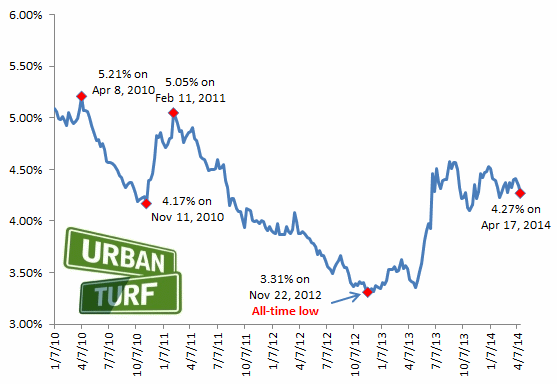

One year ago, the average on a 30-year fixed-rate mortgage was 3.41 percent. On Thursday morning, Freddie Mac reported 4.27 as the average on this type of loan. So, how does that change in rates impact your mortgage payments?

To get a sense, UrbanTurf took a home with a $500,000 purchase price and assumed our buyer has excellent credit. Using the rates from today and last year, we examined how monthly mortgage payments changed. In each case, we assumed the buyer put down a 20 percent down payment. Note that these include principal and interest, but not the cost of insurance or taxes.

Here are the two scenarios:

April 2013: The average mortgage rate was 3.41 percent.

Monthly mortgage payment: $1,776

Total outlay on mortgage (monthly payment x 360 months): $639,360

April 2014: The average mortgage rate was 4.27 percent.

Monthly mortgage payment: $1,972

Total outlay on mortgage (monthly payment x 360 months): $709,920

So, the difference between a rate of 3.41 percent and 4.27 percent is about $197 a month or $70,560 over the life of the loan.

We’re tracking the path of long-term rates since January 2010 in this chart:

See other articles related to: mortgage rates, the difference a year makes

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/197_a_month_the_difference_a_year_makes_in_interest_rates/8372.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro