Sponsored: 10 Things You Should Know About Closing Costs

Sponsored: 10 Things You Should Know About Closing Costs

✉️ Want to forward this article? Click here.

Closing costs will inevitably take a large bite out of your wallet at the settlement table — anywhere from a few to several thousand dollars.

The information in this article from Federal Title will help you better understand closing costs and teach you the right questions to ask your title or real estate agent. After you’re done reading, make sure to watch the video below for a great explanation of closing costs.

1. Homebuyers who shop title service providers save big. A recent study commissioned by Federal Title & Escrow Company based in Friendship Heights found that District of Columbia homebuyers who shop title service providers save as much as $1,180 at closing, while Maryland and Virginia homebuyers save upward of $900. Needless to say, not every title agent was thrilled by the results of the apples-to-apples comparison.

2. Some closing costs are tax-deductible. The big one to keep in mind here is any money you paid in points at closing to “buy down” the interest rate of your loan. You may also deduct pre-paid mortgage interest and property taxes paid at settlement. It’s important to note, however, that to claim these deductions you must itemize your return and forego the standard deduction. For homeowners interested in what they can and cannot deduct post-closing, see the IRS’s very thorough article on homeownership costs that are tax-deductible.

3. You must account for closing costs along with your down payment. In today’s real estate market, don’t count on a loan to help cover your closing costs. Lenders want to see that the homebuyer has enough cash on hand to meet these expenses and still have approximately six months of reserves left over once dust from the transaction settles.

4. Closing costs run roughly 3% to 6% of the purchase price. How much you pay in closing costs depends largely on where the property is located. For example, District homebuyers will pay higher closing costs than their Maryland or Virginia counterparts for a property with the same purchase price because title insurance policy premiums are higher in DC. In the last couple years, it’s become increasingly common for the home seller to pay at least a portion of the homebuyer’s closing costs. To lower your closing costs, consider asking the seller for settlement help in your sales contract.

5. Ask about “standard” title insurance versus “enhanced” title insurance. The type of title insurance policy you purchase will also affect closing costs. Some title companies push enhanced title insurance without providing the consumer with a proper disclosure that a less expensive standard policy is available. For many homebuyers, a standard policy will suffice. It’s a good idea to compare standard vs. enhanced title insurance, and make sure to ask your title company what types of insurance products they offer. Talk with your lender and settlement attorney to determine what policy is appropriate for your home investment.

A steal of a deal in the DC real estate market is increasingly rare, but by understanding your closing costs, you can make sure you’re not overpaying on the back end of your real estate transaction.

6. Closing cost discounts do exist. A handful of independently-owned title companies in Washington, DC offer homebuyers an instant rebate on their closing costs. Federal Title pioneered this practice in the DC area by introducing its REAL Credit™ program over a decade ago. Even if your chosen title company can’t offer you an instant rebate, it’s fair to note that any title company may be able to provide you a full reissue rate discount if your property is located in DC or Maryland. Typically, in order to qualify: 1) the seller must provide a copy of his or her owner’s title insurance policy; 2) that policy must be less than 10 years old; and 3) the coverage amount must equal or exceed the new purchase price.

7. Some closing costs are fixed while others are variable. The cost of your title insurance policy and government recordation fees are dependent on the purchase price of your home, and the bulk of settlement costs are typically paid by the homebuyer. However, the seller doesn’t get off scot-free. Seller fees include a fee for mortgage release procurement and deed preparations. The settlement fee is often split between buyer and seller. Homebuyer fees include a title examination/abstractor fee, location survey fee and a fee to process paperwork. A title company may charge additional fees unique to each transaction, but the extent of the fees should be disclosed up front.

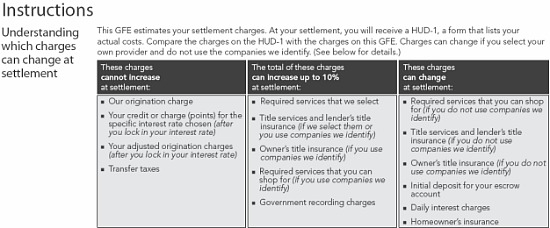

8. Closing costs should not change (much). Your lender’s Good Faith Estimate will give you a good idea of your settlement charges long before you receive a list of actual costs on your HUD-1 Settlement Statement at closing. For the most part, you shouldn’t see much discrepancy between the two forms, as your lender is legally obligated to stay within what’s known as “tolerance limitations” when it comes to most settlement charges.

To know which closing costs could change, think of settlement charges as “3 Buckets,”

which are outlined on your Good Faith Estimate.

To know which closing costs could change, think of settlement charges as “3 Buckets.” The first bucket includes your lender’s origination charges, points you paid to “buy down” your interest rate and transfer taxes. Charges in the first bucket cannot increase. Charges in the second bucket may increase up to 10 percent and include title services and a lenders title insurance policy (lumped together on line 1101 of your HUD-1), owner’s title insurance policy and government recording charges. Bucket three includes charges that can change at settlement, including daily interest charges and homeowner’s insurance, amounts that depend on your closing date.

9. Roughly 70 percent of closing costs that are variable are title-related. That’s a pretty large number to leave to chance. It may not be a bad idea to get a closing cost quote on your own from a couple title service providers just to make sure you’re getting the best deal possible. Several local companies offer free closing cost calculators to help you shop and compare rates.

10. Referral fees increase closing costs. Did you know just 5 percent of title insurance premiums go toward insurance claims, according to the Government Accountability Office? A far greater percentage (some reports claim 50 percent or more), went to real estate agents and mortgage lenders for referral fees. This practice, a product of the affiliated business arrangement, is legal but anti-consumer. Homebuyers’ best protection against high closing costs is education – simply knowing they have the right to choose their title company, asking about discounts and learning about what options are available.

Local headlines and real estate agents are saying the same thing: The DC real estate market is back! Scoff if you like, but the numbers don’t lie. A steal of a deal in the DC real estate market is increasingly rare, but by understanding your closing costs, you can make sure you’re not overpaying on the back end of your real estate transaction.

See other articles related to: closing costs, federal title, sponsored articles

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/10_things_you_should_know_about_closing_costs/3256.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro