What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

Will Mortgage Rates Drop Below 3.5 Percent?

Will Mortgage Rates Drop Below 3.5 Percent?

✉️ Want to forward this article? Click here.

Mortgage rates hit yet another record low this week. Does that sound familiar?

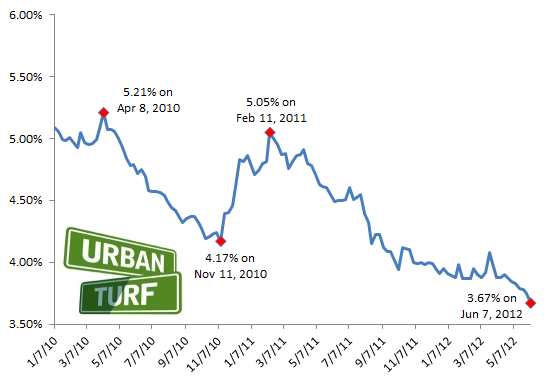

This morning, Freddie Mac reported 3.67 percent with an average 0.7 point as the average on a 30-year fixed mortgage, down quite a bit from last week’s 3.75 percent. Rates have been dropping all spring, and this is the sixth consecutive week that mortgage rates fell to a record low.

From Freddie Mac vice president and chief economist Frank Nothaft:

Fixed mortgage rates reached new record lows for the sixth consecutive week as long-term Treasury bond yields declined further following downwardly revised economic growth and job creation data. In addition, the economy added 69,000 jobs in May, less than half of the market consensus forecast and revisions subtracted a total of 49,000 workers in March and April. Lastly, the unemployment rate ticked up from 8.1 percent in April to 8.2 percent.

The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate. Still, rates are at historical lows.

Below is a look at the path of rates since last January. Question for our readers: When do you think long-term rates will drop below 3.5%?

See other articles related to: freddie mac, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/will_mortgage_rates_drop_below_3.5_percent/5629.

Most Popular... This Week • Last 30 Days • Ever

Only a few large developments are still in the works along 14th Street, a corridor th... read »

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro