Where Will Interest Rates Head in 2016?

Where Will Interest Rates Head in 2016?

✉️ Want to forward this article? Click here.

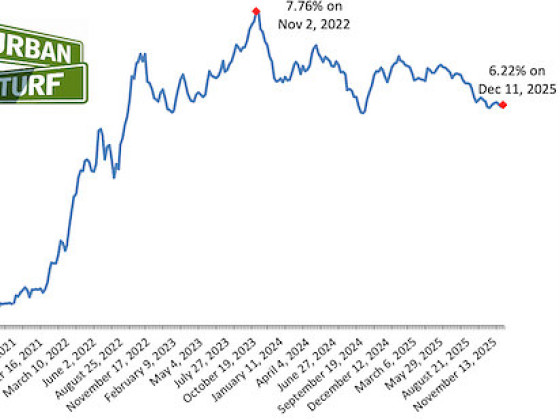

For most of 2015, long-term interest rates hovered around 4 percent before a run of five months in the 3.5 to 4 percent range. And then on New Year’s Eve, rates inched back above 4 percent. That move was accompanied by a prediction from Freddie Mac’s chief economist Sean Becketti that rates could be averaging 4.7 percent by the end of 2016, a level that long-term rates haven’t seen in years.

Naturally, this move has UrbanTurf and local buyers wondering where rates will be headed this year. We asked a few local lenders to look into their crystal ball and give us their prediction.

Rates Will Stay in The Low to Mid-4 Percent Range

John Downs, Caliber Home Loans – Downs Capital Partners

Interest rates have certainly been the top conversation of the year as we counsel home buyers and our real estate partners. Generally speaking, the bias is towards rates rising however I’m not really sold on that. In 2014, every analyst was predicting higher rates and they ended up being wrong. There isn’t an easy answer as to why it didn’t happen. The global markets are wound so tightly together that we are no longer trading on just the U.S. economy. With the free flow of global money, our bonds look very appealing, especially as the dollar strengthens and short term yields rise with the Fed.

I believe that rates will stay in a very narrow range (low to mid-4 percent) for most of 2016. Inflation pressures are just too stagnant with oil prices continuing to stay depressed coupled with a lack of strong wage growth in the employment markets. Global growth concerns continue to plague the equity markets with uncertainty which should also give a boost to the bond markets.

story continues below

loading...story continues above

The Global Economy Will Keep Rates Low

Patrick Gardner, 1st Portfolio Lending

The higher rate prediction from Freddie Mac is common, particularly with the recent Fed rate increase. However, they’ve had higher interest rate predictions for the last few years because everyone knows they have to increase at some point to move off of unsustainable low rates. The fact that they’ve been incorrect is simply because the economy is not as strong as they had predicted or hoped. I think this holds true again in 2016 and while rates may be volatile and rise to 4.7 percent temporarily, rates will average lower over the course of the year as the global economy struggles forward.

See other articles related to: mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/where_will_interest_rates_head_in_2016/10733.

Most Popular... This Week • Last 30 Days • Ever

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

The 30,000 square-foot home along the Potomac River sold at auction on Thursday night... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro