The Shutdown Effect: A Chill On The October Market

The Shutdown Effect: A Chill On The October Market

✉️ Want to forward this article? Click here.

The effects of the federal government shutdown and broader economic uncertainty filtered into homebuyer and seller behavior across the DC area in October, according to a new report out today.

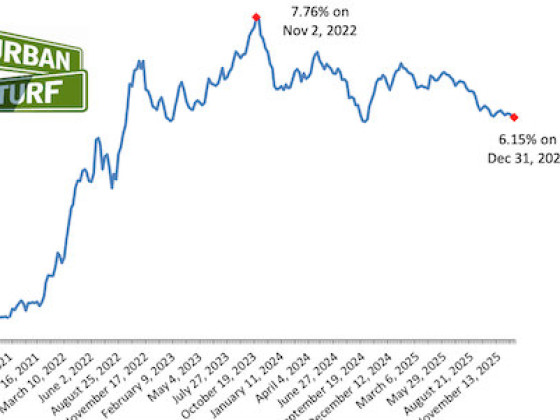

The report from Bright MLS finds that closed sales across the region were flat compared to last October, while new pending sales rose by just 0.7% year-over-year — modest movement despite mortgage rates hitting a 13-month low. The cautious pace reflects a market that appears to be recalibrating amid fluctuating confidence and limited urgency for buyers.

DC proper was the biggest drag on the regional market, with activity cooling significantly since the summer.

Closed sales in the city fell by 9.3% compared to a year ago, while pending contracts dropped 15.6%. The slowdown follows several months of uneven buyer demand and an uptick in listings, creating conditions where sellers are more likely to wait out uncertainty than rush to market. For many prospective buyers, even slightly lower mortgage rates have not been enough to offset job insecurity and the uncertainty caused by the ongoing shutdown.

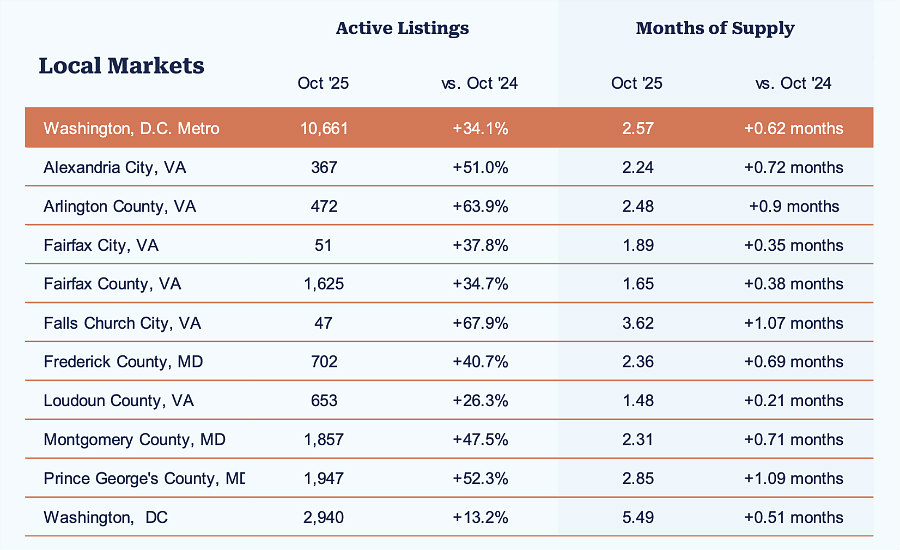

Meanwhile, inventory continues to expand across the metro area. At the end of October, there were 10,661 homes for sale — a 34.1% increase from a year earlier. The inventory of homes on the market rose by double-digit percentage points in every local jurisdiction.

Despite the slower market, home prices are actually increasing. The median sales price for the region in October reached $630,000, up 5% year-over-year, with higher-end buyers driving much of that growth. In the District, the median price climbed a more modest 2.3%, suggesting that the luxury segment is sustaining overall price gains even as transaction volume slows.

“While the DC area housing market has been fairly resilient, we are definitely seeing some cracks,” Dr. Lisa Sturtevant, Bright MLS Chief Economist, said. “If the shutdown persists and if federal workers do not get back pay, we will see a much slower housing market in the region in November and December.”

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/the_shutdown_effect_on_the_october_market/24057.

Most Popular... This Week • Last 30 Days • Ever

Title insurance is a form of insurance that protects against financial loss from defe... read »

Plans are to transform a vacant office building into a mixed-use residential communit... read »

In news that will make homebuyers and sellers alike happy, mortgage rates dropped to ... read »

Quadrangle Development Corporation has revealed plans for Potomac Overlook.... read »

The DC region closed out 2025 with four consecutive months of declining rents, with m... read »

- What is Title Insurance and How Does it Work?

- Pulte Plans 106-Unit Residential Development at North Bethesda Office Site

- Long-Term Mortgage Rates Drop To Lowest Level In A Year

- A Nearly 1,800 Unit Development Pitched For Former Key Bridge Marriott Site

- DC Area Rents Fell For The Final Four Months Of 2025

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro