What's Hot: 110-Unit Condo Project Planned in Alexandria Coming Into Focus | DC's Most Anticipated Restaurant To Open Its Doors

Should DC Use Inclusionary Conversions to Meet Affordable Housing Goals?

Should DC Use Inclusionary Conversions to Meet Affordable Housing Goals?

✉️ Want to forward this article? Click here.

A new report by the DC Policy Center suggests there may only be one way to reach DC's affordable housing production targets.

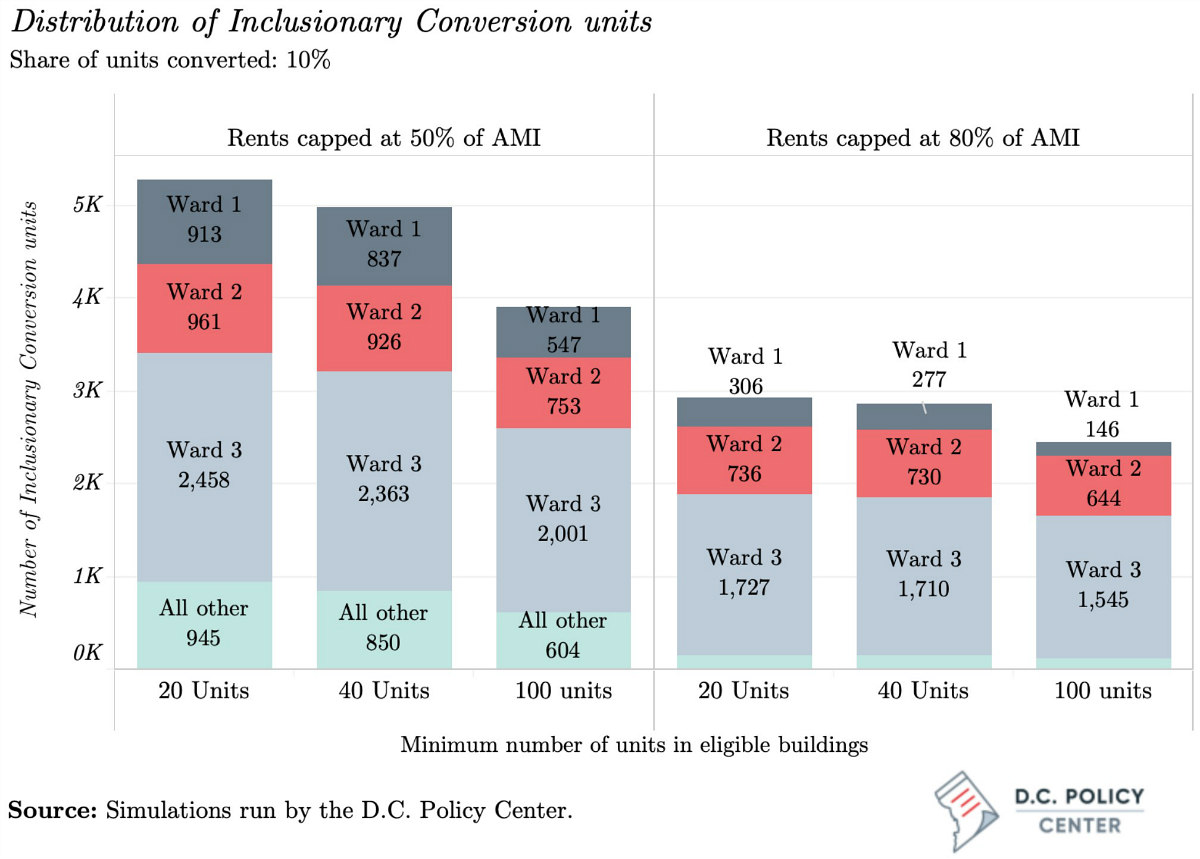

Released Wednesday, the extensive report takes stock of the city's rental housing, putting forth the concept of "Inclusionary Conversions" (IC) as an efficient option to subsidize the creation of rental apartments affordable to households earning up to 50 or 80 percent of area median income (AMI). Inclusionary conversions would result in a certain share of units in rent-controlled buildings being converted into units subsidized for a period of 15 or 40 years. If 10% of the units in the city's rent-controlled buildings were converted, this would create up to 5,300 newly-affordable apartments.

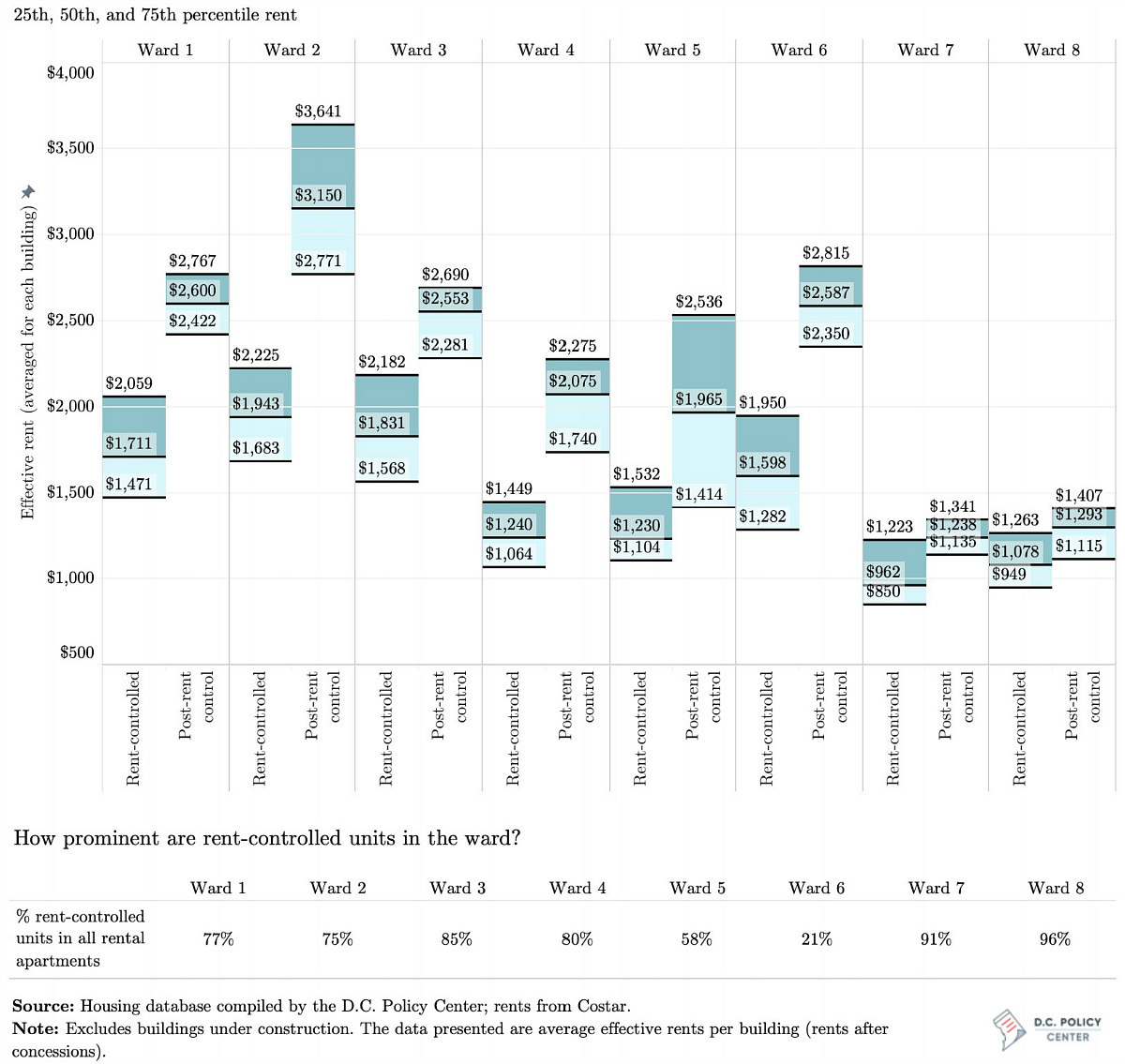

Because of the prevalence of older, rent-controlled multifamily stock in Wards 1, 2 and 3, these wards would be poised to gain the most affordable housing via this method. Wards 1, 2, and 3 also serve as an example of how rent control does not necessarily correlate with affordability. Ward 3 in particular has the largest quantity and the largest proportion of rent-controlled units citywide, with those 13,674 units accounting for 85% of the total apartment stock.

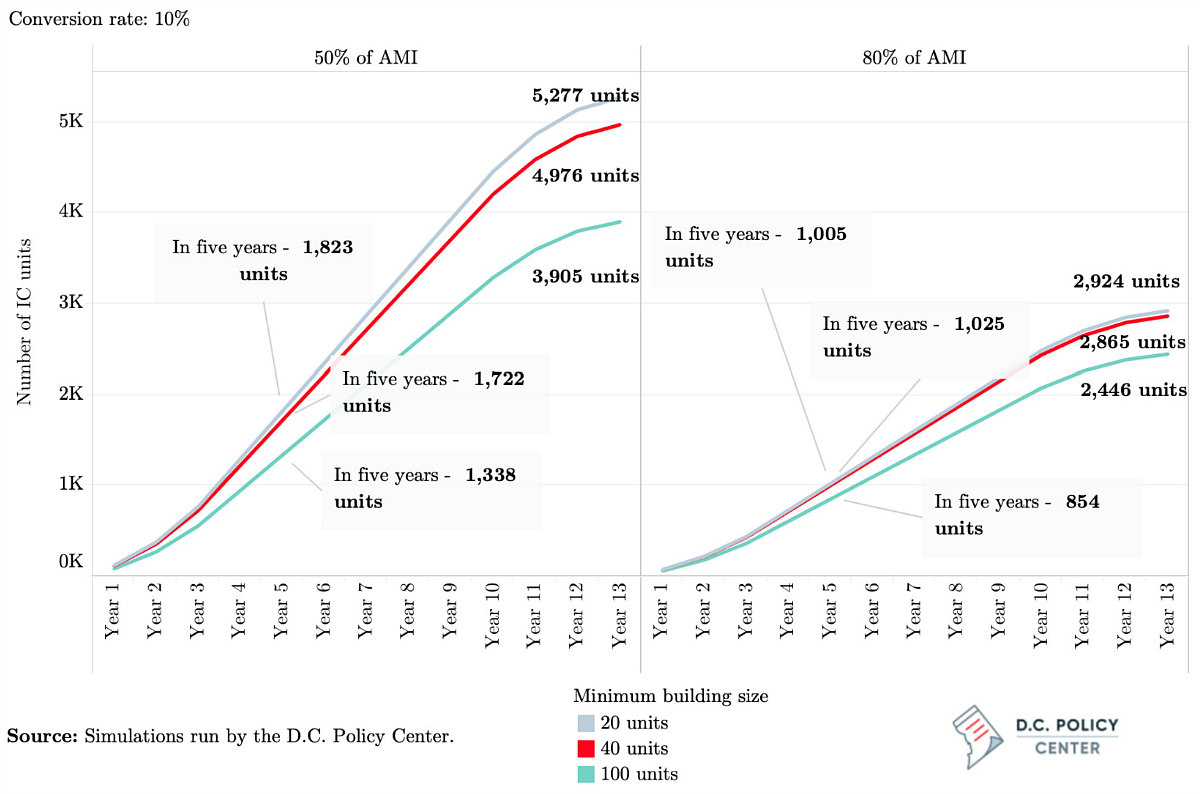

If IC is implemented for buildings with at least 100 units, 3,905 affordable units could be created for households earning up to 50% AMI, or 2,446 affordable units could be created for households earning up to 80% AMI. For Ward 3, those numbers would be 2,001 and 1,545, respectively; all but the latter number are higher than the mayor's affordable unit target for west of Rock Creek Park.

"The Bowser administration’s neighborhood-specific goals signal a forceful commitment to economic inclusivity, but to realize them, D.C. needs new policy tools. For instance, in neighborhoods west of Rock Creek Park, the administration’s plan calls for 1,260 new housing units, and 1,910 new affordable homes. This means the affordable housing goals can only be met by converting existing non-subsidized stock into affordable units."

Implementing IC for buildings with at least 20 units could yield 5,277 affordable units for households earning up to 50% AMI, or 2,924 affordable units for households earning up to 80% AMI.

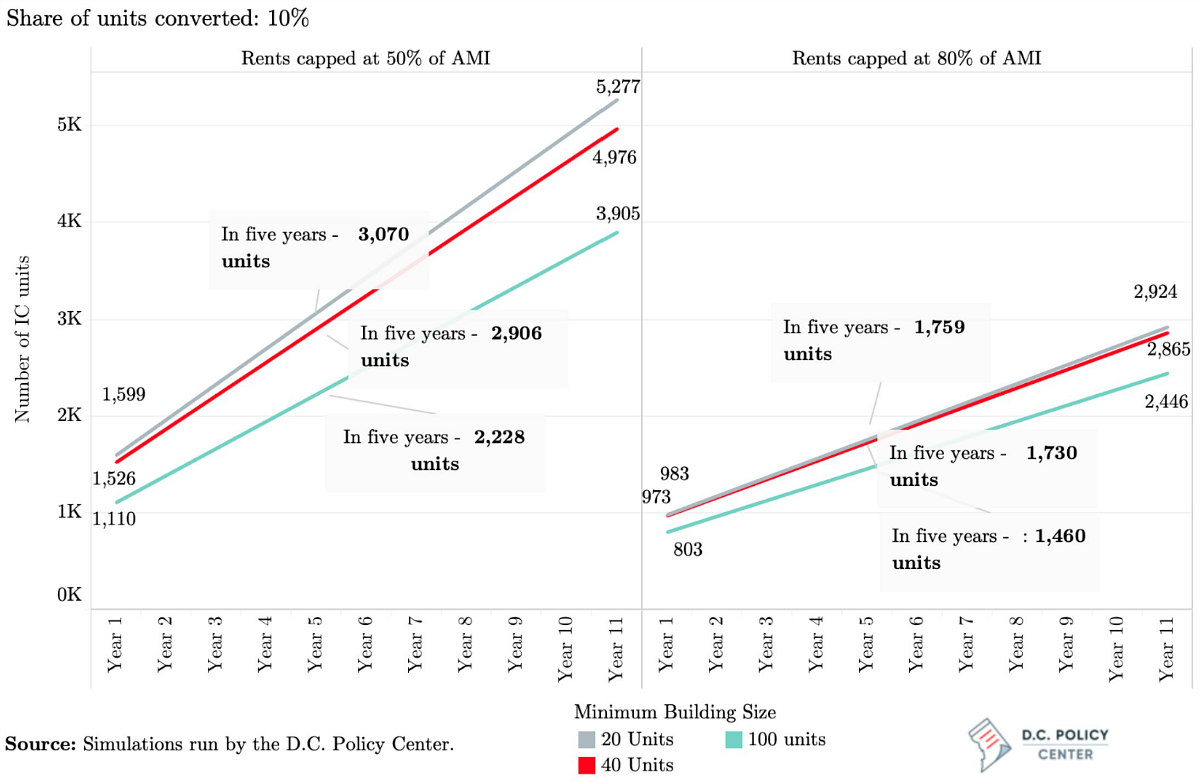

It is suggested that these conversions would begin with units that are already vacant and continue with other units when there is turnover. The city could implement IC with either a one-time cash infusion when a building is refinanced, similarly to how the Housing Production Trust Fund (HPTF) operates, or via subsidy payments on each unit to cover the difference between the rental rate and the 30% affordability threshold recommended for households.

A one-time cash infusion would be slower to implement, but would also be more affordable to the city, saving $20 million for units at 80% AMI on a 15-year covenant or $710 million for units at 50% AMI on a 40-year covenant. However, also similarly to HPTF funding, a one-time infusion could leave more room for landlords to neglect maintenance.

No matter the financing method, the report concludes that IC could reach its potential in 13 years and would be a less expensive option for DC to create affordable units than what is currently being done.

These conclusions are based on capping the IC share of each eligible building at 10%, similarly to inclusionary zoning. The projections also assume that 75% of vacancies are converted annually. On the policy side, the outcomes of an IC program would depend on how long affordability covenants stay in place, the targeted affordability levels, the eligible building size, and the share of units converted. On the market side, effectiveness could also be impacted by factors like the rent subsidies and building maintenance needed.

See other articles related to: affordability, affordability covenant, dc policy center, dcpc, inclusionary conversion, inclusionary zoning, rent affordability, rent control, rent control dc

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/should-dc-use-inclusionary-conversions-to-meet-affordable-housing-goals/16665.

Most Popular... This Week • Last 30 Days • Ever

A look at the closing costs that homebuyers pay at the closing table.... read »

3331 N Street NW sold in an off-market transaction on Thursday for nearly $12 million... read »

Paradigm Development Company has plans in the works to build a 12-story, 110-unit con... read »

The development group behind the hotel has submitted for permit review with DC's Hist... read »

The map and text amendment applications that were filed with the Commission last Octo... read »

- How Do Closing Costs Work in DC

- Georgetown Home Sells For $11.8 Million, Priciest Sale in DC In 2024

- 110-Unit Condo Project Planned in Alexandria Coming Into Focus

- Georgetown Hotel That Is Partnering With Jose Andres Looks To Move Forward

- The Zones That Could Lead To More Development in Chevy Chase Set To Go Before Zoning Commission

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro