Report: Homeowners Getting Back on the Right Track

Report: Homeowners Getting Back on the Right Track

✉️ Want to forward this article? Click here.

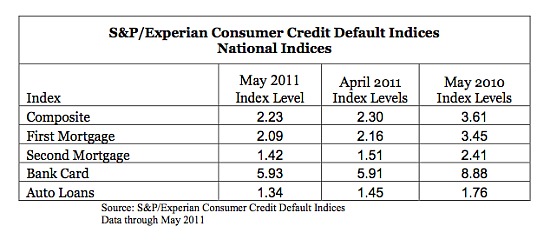

A recent report from Standard & Poor’s and Experian revealed that first and second mortgage default rates decreased last month to 2.09 percent and 1.42 percent, respectively, down from April values of 2.16 percent and 1.51 percent.

However, the real change in these rates can be seen over the last 12 months. A year ago, default rates for first mortgages stood at 3.45 percent and 2.41 percent for second mortgages. This drop is statistical evidence that homeowners are getting their balance sheets in order.

From the report:

“While we might observe volatility from month-to-month, looking at default rates over the past few years it is easy to see that consumers have come a long way in fixing their balance sheets,” says David M. Blitzer, Managing Director and Chairman of the Index Committee for S&P Indices. “All indices show default rates below where they were this time last year, and more so if you look back to 2008/2009.”

To put the current rates into perspective, in May 2009, the default rate for first mortgages was 5.67 percent and 4.41 percent for second mortgages.

See other articles related to: default rates, experian, mortgage rates, standard and poor's

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/report_homeowners_getting_back_on_the_right_track/3706.

Most Popular... This Week • Last 30 Days • Ever

The differences between condo fees and co-op fees might seem small, but there are som... read »

Title insurance is a form of insurance that protects against financial loss from defe... read »

For our first development rundown of the year, UrbanTurf catches up on the latest new... read »

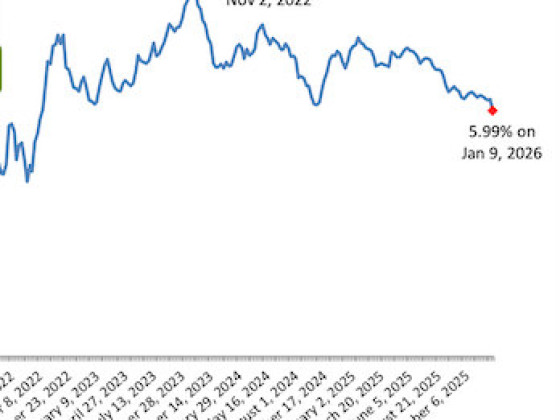

The benchmark rate fell to 5.99%, marking a significant psychological threshold for a... read »

On Wednesday, President Donald Trump announced that his administration is taking step... read »

- What Are the Differences Between Condo Fees and Co-op Fees?

- What is Title Insurance and How Does it Work?

- The 4 Developments On The Boards Around Howard University

- 30-Year Mortgage Rates Drop Below 6% For First Time In Years

- Trump Administration Moves to Ban Institutional Investors from Single-Family Home Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro