Buying Now Twice as Affordable as Renting, Zillow Says

Buying Now Twice as Affordable as Renting, Zillow Says

✉️ Want to forward this article? Click here.

Buying a home is currently two times more affordable than renting one, and the divide is only growing, a new report from Zillow concludes.

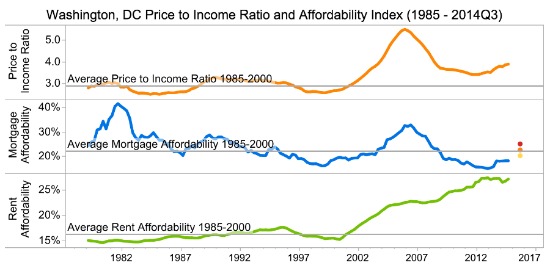

The study compared average affordability between 1985 and 2000, when buyers were paying about 22 percent of their income into their mortgage and a little more — 25 percent — into renting, with today’s affordability. Now, home owners are devoting about 15 percent of their income to their mortgage, while renters pay upwards of 30 percent towards the monthly rent. The advantage in favor of buying comes thanks to low interest rates and post-recession home prices, according to Stan Humphries, Zillow’s chief economist, who wrote about the report on Twitter.

Even potential buyers who would have to pay mortgage insurance and can’t pony up a large down payment would find it more affordable to purchase, according to the report, which took into account data from the third quarter of 2014. Renting has become historically unaffordable in California and all of the 35 biggest metros, Zillow noted.

The District follows this same pattern. In DC, renters are on average paying 27 percent of their monthly income into housing, up from an average of 16 percent between 1985 and 2000. Homeowners, on the other hand, are spending about 18 percent of their income on housing, down from 22 percent between 1985 and 2000. And first-time homebuyers, those whose home owning costs likely outpace long-time owners with more equity, are paying 24 percent of their income into housing — still less than a renter, according to a HousingWire analysis of Zillow’s data.

Humphries predicts that the discrepancy will continue to widen into next year.

“Affordability will force more renters to consider buying, especially younger renters,” he wrote on Twitter. “2015: Millennials become biggest buying group.”

See other articles related to: renting in dc, renting vs. buying, zillow

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/renting_is_twice_as_expensive_as_buying_zillow_says/9312.

Most Popular... This Week • Last 30 Days • Ever

Title insurance is a form of insurance that protects against financial loss from defe... read »

Plans are to transform a vacant office building into a mixed-use residential communit... read »

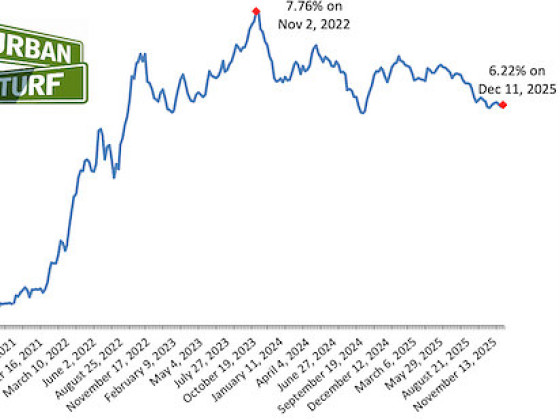

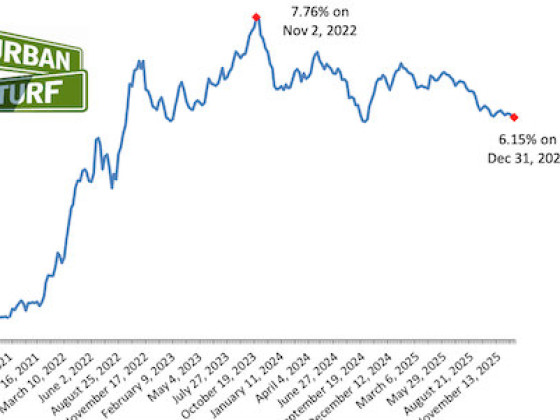

In news that will make homebuyers and sellers alike happy, mortgage rates dropped to ... read »

Quadrangle Development Corporation has revealed plans for Potomac Overlook.... read »

The DC region closed out 2025 with four consecutive months of declining rents, with m... read »

- What is Title Insurance and How Does it Work?

- Pulte Plans 106-Unit Residential Development at North Bethesda Office Site

- Long-Term Mortgage Rates Drop To Lowest Level In A Year

- A Nearly 1,800 Unit Development Pitched For Former Key Bridge Marriott Site

- DC Area Rents Fell For The Final Four Months Of 2025

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro