What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

Mortgage Demand Slow To Respond To Falling Rates

Mortgage Demand Slow To Respond To Falling Rates

✉️ Want to forward this article? Click here.

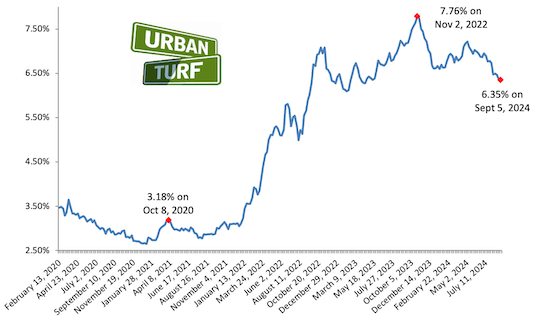

Mortgage demand continues to be slow to respond to falling interest rates.

Rates dropped for the sixth week in a row last week and total mortgage application volume rose just 1.4%, the Mortgage Bankers Association (MBA) reported on Wednesday. Applications to purchase a home rose 2% week-over-week, and refinance applications increased 1%.

“There is still somewhat limited refinance potential as many borrowers still have sub-5 percent rates," MBA economist Joel Kan said in a release. “Despite the drop in rates, affordability challenges and other factors such as limited inventory might still be hindering purchase decisions.”

See other articles related to: mortgage demand

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/mortgage_demand_slow_to_respond_to_falling_rates/22698.

Most Popular... This Week • Last 30 Days • Ever

The penthouse at 1208 M is a duplex with two bedrooms and two-and-a-half-bathrooms, a... read »

Rocket Companies is taking a page from the Super Bowl advertising playbook with a spl... read »

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro