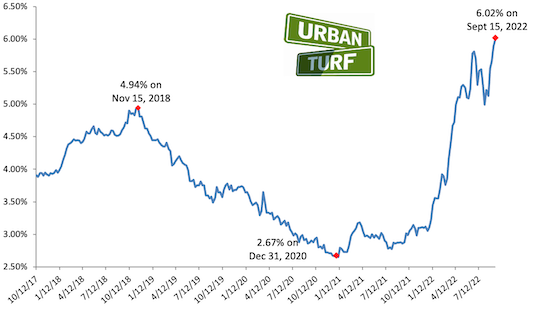

Mortgage Rates Rise Above 6% For First Time Since 2008

Mortgage Rates Rise Above 6% For First Time Since 2008

✉️ Want to forward this article? Click here.

Long-term mortgage rates topped 6% for the first time in 14 years on Thursday.

Freddie Mac reported 6.02% with an average 0.8 point on Thursday. Thirty-year rates have not been this high since 2008.

story continues below

loading...story continues above

“Mortgage rates continued to rise alongside hotter-than-expected inflation numbers this week, exceeding six percent for the first time since late 2008,” Freddie Mac's Sam Khater said. “Although the increase in rates will continue to dampen demand and put downward pressure on home prices, inventory remains inadequate. This indicates that while home price declines will likely continue, they should not be large.”

With interest rates rising this high, it is important to understand how points work. See UrbanTurf's primer on mortgages and points from earlier this week here.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: freddie mac, interest rates, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/mortgage-rates-rise-above-6-for-first-time-since-2008/20084.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro