How a Government Shutdown Could Affect Home Loans

How a Government Shutdown Could Affect Home Loans

✉️ Want to forward this article? Click here.

The federal government could be shut down by the end of today, and that shutdown could effect homebuyers, particularly when it comes to home loans.

Fannie Mae and Freddie Mac will likely still continue processing mortgage loan applications despite a shutdown, however, federal government employees in the midst of buying a home may not be able to have their incomes verified.

story continues below

loading...story continues above

During past shutdowns, Fannie Mae has issued guidance for how its verification and approval process will operate, noting that some aspects of the process (like acquisition of IRS transcript verification reports and social security verification) will be delayed until the government is funded and operational. The agency is usually unable to purchase loans that closed and delivered prior to an applicant having verbal verification of employment, however. Mortgagees may also be able to secure mortgage loan forbearance if they are not being paid during the shutdown.

If a shutdown happens, the Federal Housing Administration (FHA) may become backlogged with mortgage loan applications due to having fewer staff on hand. The Department of Housing and Urban Development (HUD) will also (slowly) continue to approve mortgage loans for single-family homes, although the agency will be be unable to approve financing for pending multifamily projects.

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/how_a_government_shutdown_could_effect_home_loans/21511.

Most Popular... This Week • Last 30 Days • Ever

The mortgage interest deduction allows homeowners who itemize their taxes to reduce t... read »

An incredibly rare opportunity to own an extraordinary Maryland waterfront property, ... read »

Georgetown is one of the busiest neighborhoods for development in the city.... read »

The large-scale residential development will head to before the Montgomery County Dev... read »

Leading the way is the 20015 zip code where almost half of homeowners are considered ... read »

- How Does The Mortgage Interest Deduction Work?

- 28 Acres, 1,500 Feet of Potomac River Waterfront: Sprawling Estate Hits The Market Just South of DC

- Hotels, Heating Plants & Conversions: The 10 Big Projects In The Works In Georgetown

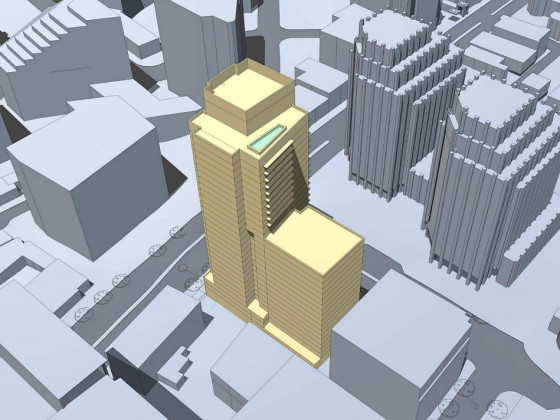

- 29-Story, 420-Unit Development Pitched For Bethesda Moves Forward

- New Report Looks At Where Owners Are House Rich In DC

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro