The Hidden Benefits of FHA Loans

The Hidden Benefits of FHA Loans

✉️ Want to forward this article? Click here.

The primary appeal of an FHA-backed loan is its very low down payment requirement of 3.5%. But John Settles—FHA loan expert and DC branch manager for Wells Fargo—uncovered a few other, lesser-known benefits of this loan product.

What is the difference between the loan limits for conventional and FHA loans?

JS: FHA loans have higher loan limits than conventional loans. The maximum FHA loan limit for a single-family home in DC is $729,750, compared to a $625,000 limit on conventional loans. For buyers in that price point, this can make all the difference.

For example, if a buyer purchases a $755,000 house with conventional, non-conforming loan, they’d have to put down 20%, or $151,000; but with an FHA loan at 3.5%, their down payment would be $26,000—a difference of $125,000.

How do FHA loans treat credit issues?

JS: FHA loans are more accommodating than conventional loans in regard to both debt-to-income ratios (allowing for as much as a 49-50% DTI) and credit scores. The FHA reviews just one to two years of credit history and allows for scores as low as 640.

What are the advantages of having an FHA loan when purchasing a multi-unit property?

JS: FHA allows the same low down payment of 3.5% for multi-family properties (2-4 units) as it does for single-family homes. Multi-family properties purchased with a conventional loan, meanwhile, have a down payment of 20%.

To quantify those percentages, here’s an example: If you buy a 3-unit building in NW for $900,000, your down payment on an FHA loan would be $31,500; your down payment with a conventional loan would be $180,000.

In addition to a lower loan rate, FHA allows you to count 75% of the rental income on a multi-family property as part of your qualifying income, enabling you to afford considerably higher monthly payments. The end result? You could consider a duplex or a three-unit home in a neighborhood that you couldn’t otherwise afford. (Note that you must live in the property to do this.)

What does it mean that FHA loans are assumable?

JS: This means that the buyer of your home can assume your loan at the rate you initially secured. This is particularly valuable now, with rates at record-breaking lows. When the time comes to sell your property, interest rates will almost certainly be higher than today. The assumability of your FHA loan will give prospective buyers access to that historically-low rate, making your home a better deal than comparable properties.

Get in touch with a loan expert, like John Settles (NMLS448870), by phone at 202-216-5702 and find out if an FHA-backed loan would work for you. Or request a consultation by visiting the Wells Fargo website here.

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/hidden_benefits_of_fha_loans/6316.

Most Popular... This Week • Last 30 Days • Ever

Title insurance is a form of insurance that protects against financial loss from defe... read »

Plans are to transform a vacant office building into a mixed-use residential communit... read »

In news that will make homebuyers and sellers alike happy, mortgage rates dropped to ... read »

Quadrangle Development Corporation has revealed plans for Potomac Overlook.... read »

The DC region closed out 2025 with four consecutive months of declining rents, with m... read »

- What is Title Insurance and How Does it Work?

- Pulte Plans 106-Unit Residential Development at North Bethesda Office Site

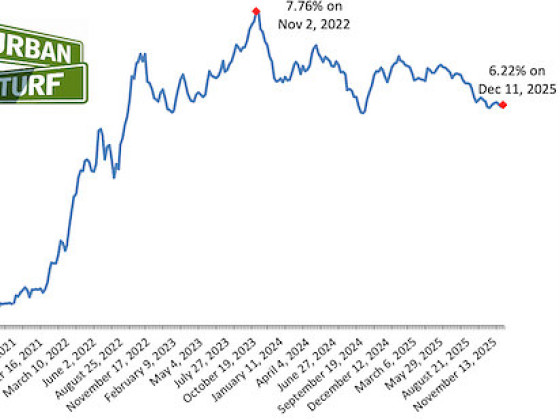

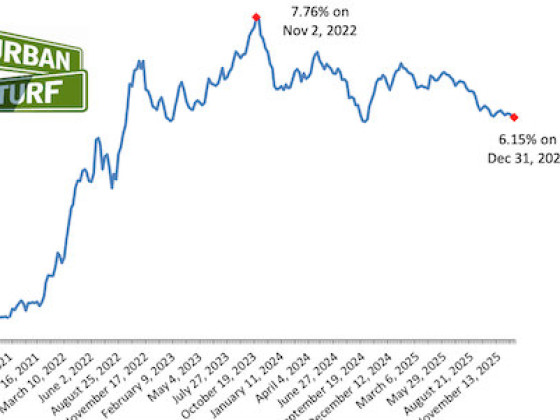

- Long-Term Mortgage Rates Drop To Lowest Level In A Year

- A Nearly 1,800 Unit Development Pitched For Former Key Bridge Marriott Site

- DC Area Rents Fell For The Final Four Months Of 2025

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro