DC's Leading Lender Gives Homebuyers a Competitive Edge

DC's Leading Lender Gives Homebuyers a Competitive Edge

✉️ Want to forward this article? Click here.

Home buyers in DC know that to win in a multiple offer situation you must be aggressive and competitive. First Savings Mortgage, the city’s top lender in dollar volume for a third year running, is keenly aware of this fact. To date, they’ve closed over $43 billion in mortgages by becoming experts in efficiency and all things local.

First Savings Mortgage is a direct lender that provides in-house underwriting, processing and closings. All of the firm’s appraisals are performed by local, licensed real estate appraisers, and the First Savings team prides itself on never missing a closing date. The firm’s sturdy local reputation and retained earnings enhances their clients’ appeal to sellers, giving them an edge over competitors.

This year, First Savings Mortgage continues to improve efficiencies by debuting a new website and processing system in June to streamline customer experience.

Led by the same top-level executive since its founding in 1989, First Savings Mortgage enjoys a loyal following and has built lasting relationships with everyone from top local developers and entrepreneurs to first-time homebuyers and graduate students. Last year, the team closed just shy of $2 billion in sales volume, with their top five loan officers closing just over $100 million each.

First Savings offers a full suite of loan products including Conventional, Jumbo, FHA, and VA loans, as well as Renovation Financing, Second Liens and Bridge Financing. In addition to traditional and conventional financing, the firm offers customized products designed to meet unique financing needs.

First Savings operates two Washington, DC, offices in Logan Circle and Capitol Hill, as well as offices in Virginia and Maryland.

To learn more about First Savings Mortgage, visit their website here or contact a loan officer through the firm’s contact page here.

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/dcs_leading_lender_gives_homebuyers_a_competitive_edge/12545.

Most Popular... This Week • Last 30 Days • Ever

Title insurance is a form of insurance that protects against financial loss from defe... read »

Plans are to transform a vacant office building into a mixed-use residential communit... read »

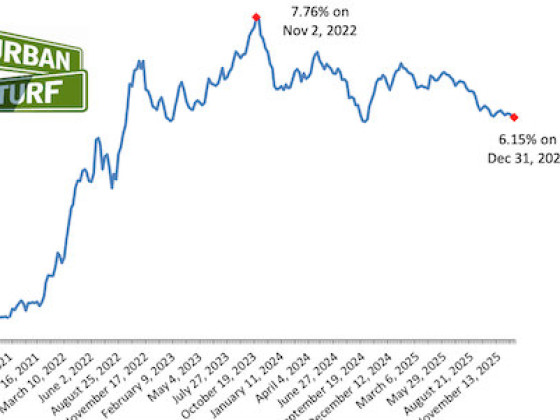

In news that will make homebuyers and sellers alike happy, mortgage rates dropped to ... read »

Quadrangle Development Corporation has revealed plans for Potomac Overlook.... read »

The DC region closed out 2025 with four consecutive months of declining rents, with m... read »

- What is Title Insurance and How Does it Work?

- Pulte Plans 106-Unit Residential Development at North Bethesda Office Site

- Long-Term Mortgage Rates Drop To Lowest Level In A Year

- A Nearly 1,800 Unit Development Pitched For Former Key Bridge Marriott Site

- DC Area Rents Fell For The Final Four Months Of 2025

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro