What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

DC Area Refinance Applications up 180%

DC Area Refinance Applications up 180%

✉️ Want to forward this article? Click here.

In the past week, UrbanTurf has reported on how low mortgage rates compelled a wave of demand for homeowners looking to refinance. Now, a new report is putting some numbers to refinancing demand at the end of the last year.

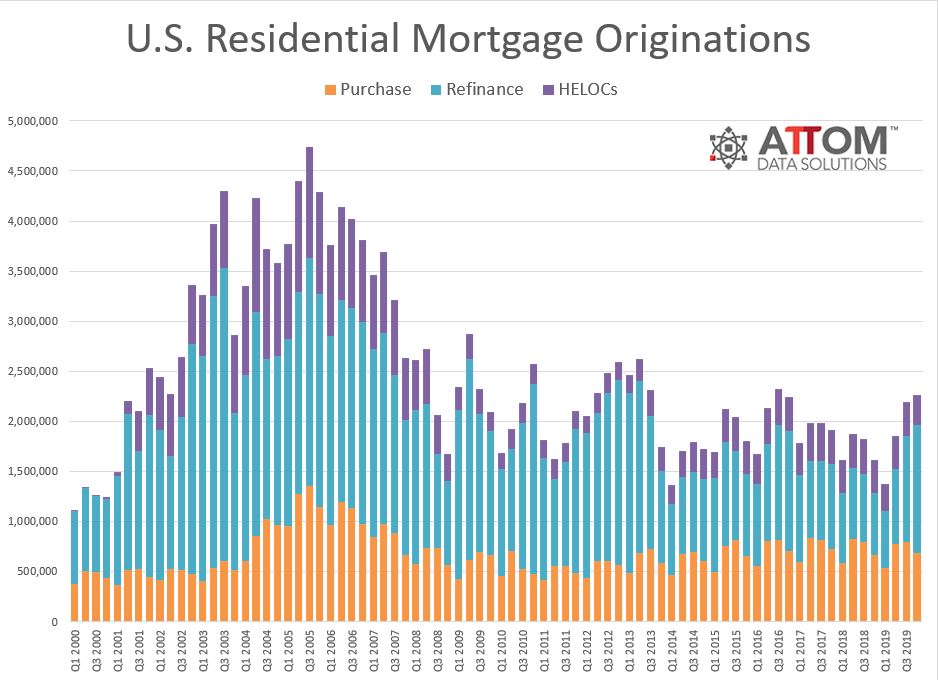

A new report from ATTOM Data Solutions shows that 1.27 million owners of buildings with 1-4 units secured refinancing mortgages nationwide in the fourth quarter of 2019. This was a 104% year-over-year increase and the highest amount for any quarter since the third quarter of 2013.

story continues below

loading...story continues above

In the DC metro area, there were 30,757 refinanced mortgages in the fourth quarter of 2019, a whopping increase of 180% year-over-year.

However, when looking at these numbers, it is important to note that the refinancings from the fourth quarter of 2018 represented the lowest level for a quarter since the third quarter of 2000, when 10,766 mortgages were refinanced.

It remains to be seen whether recent spikes in mortgage rates will tamp down demand — and what impact coronavirus may have on appetites to refinance.

Note: The DC metropolitan statistical area includes Frederick, Maryland and Jefferson County, West Virginia.

See other articles related to: attom data solutions, mortage refinance, refinancing

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/dc-area-mortgage-refinance-applications-up-180/16619.

Most Popular... This Week • Last 30 Days • Ever

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A report out today finds early signs that the spring could be a busy market.... read »

A potential collapse on 14th Street; Zuckerberg pays big in Florida; and how the mark... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro