A Mortgage Program for Doctors New To the DC Area

A Mortgage Program for Doctors New To the DC Area

✉️ Want to forward this article? Click here.

One of Fulton Mortgage Company's most popular mortgage programs is one that makes homeownership more attainable for doctors in the DC metro region.

Fulton Mortgage Company’s Medical Professionals Program is for medical professionals1 including physicians, pharmacists, dentists and veterinarians.

The Fulton Bank Medical Professionals Program offers:

- 100% financing available for loan amounts up to $1 Million2

- 95% financing available for loan amounts up to $1.5 Million2

- 90% financing available for loan amounts up to $2 Million2

- 30 & 15 Year Fixed Rate3 as well as Adjustable Rate4 Options (5/1, 7/1, 10/1, & 15/1)

This program can be used to purchase or refinance a mortgage. Up to 6% seller paid closing cost and prepaids are allowed, and gift funds are allowed from immediate family members. Student loan payments that are deferred for 12 months or longer are not included in the credit approval process. For qualifying borrowers, no private mortgage insurance (PMI) is required. In order to qualify, the borrower must find and close on their new home up to 90 days prior to start of new employment and be 15 years out of their medical residency/fellowship.

Nurses and other medical professionals looking for a mortgage program should consider the Fulton Bank Community Combo program. To learn more, click here.

For more information about the program, contact Noel Shepherd (NMLS #: 313280) at 202.642.4305 or nshepherd@fultonmortgagecompany.com; or visit him online at fultonmortgagecompany.com/noelshepherd.

Fulton Bank, N.A. Member FDIC. Subject to credit approval. 1Medical Doctorate degree required. Restrictions apply. 2Financing is based on the lower of either the appraised value (fair market value) or contract sales price. 3Monthly payment for a $250,000 15-year term mortgage at 3.582% Annual Percentage Rate (APR) would be $1,774.71. Monthly payment for a $250,000 30-year term mortgage at 3.582% Annual Percentage Rate (APR) would be $1,108.43. Payment does not include amounts for taxes and insurance and the actual payment will be greater. 4Adjustable rates are subject to increase after the initial fixed-rate period.

See other articles related to: Fulton Mortgage Company

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/a-mortgage-program-for-doctors-new-to-the-dc-area/18081.

Most Popular... This Week • Last 30 Days • Ever

The mortgage interest deduction allows homeowners who itemize their taxes to reduce t... read »

Rocket Companies is taking a page from the Super Bowl advertising playbook with a spl... read »

An incredibly rare opportunity to own an extraordinary Maryland waterfront property, ... read »

The large-scale residential development will head to before the Montgomery County Dev... read »

Georgetown is one of the busiest neighborhoods for development in the city.... read »

- How Does The Mortgage Interest Deduction Work?

- The Super Bowl Ad That Will Give Away A Million-Dollar Home

- 28 Acres, 1,500 Feet of Potomac River Waterfront: Sprawling Estate Hits The Market Just South of DC

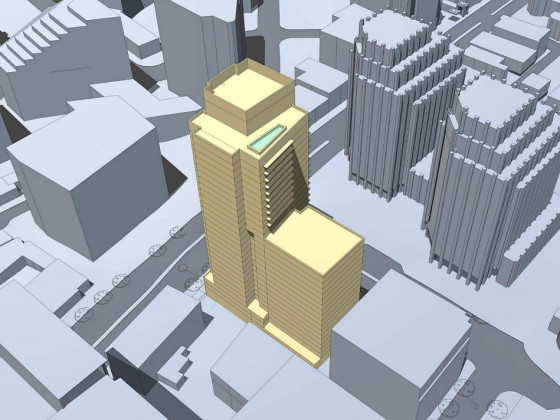

- 29-Story, 420-Unit Development Pitched For Bethesda Moves Forward

- Hotels, Heating Plants & Conversions: The 10 Big Projects In The Works In Georgetown

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro