What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

6,500 Class A Apartments Will Deliver in DC This Year While Amazon Bolsters NoVa Market

6,500 Class A Apartments Will Deliver in DC This Year While Amazon Bolsters NoVa Market

✉️ Want to forward this article? Click here.

A new report from Delta Associates on the Class A apartment market in the DC region shows that overall apartment absorption was subdued in 2018. However, that will likely change this year.

9,177 Class A apartments were absorbed in 2018 with the District accounting for 42 percent of those units. Rents rose in DC last year by almost 4 percent. DC proper remains the only jurisdiction where absorption went up (7 percent); absorption fell by 49 percent and 17 percent respectively in Northern Virginia and suburban Maryland. However, the specter of Amazon is expected to shift these dynamics over the next few years.

story continues below

loading...story continues above

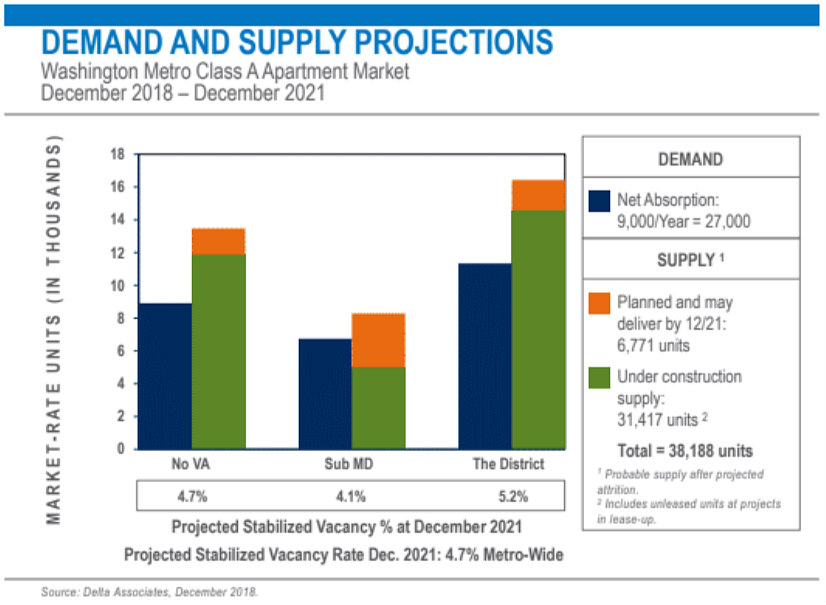

"Absorption in Northern Virginia is expected to improve in the period ahead as deliveries will increase significantly in 2019 in Arlington and Alexandria, near Amazon's new HQ2 campus," the report states. Regionwide, the effect will be somewhat muted, as Delta Associates still predicts annual absorption of roughly 9,000 units on average.

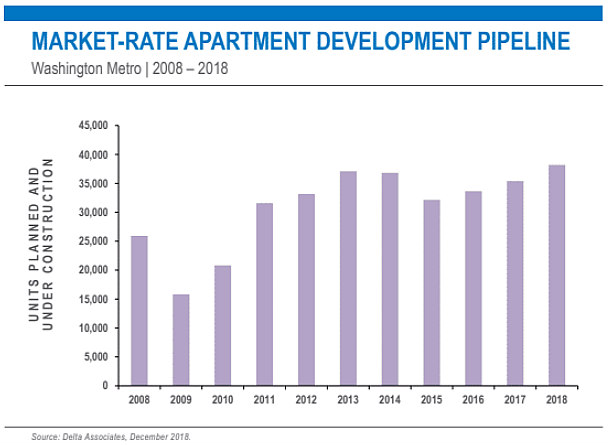

The number of Class A apartments scheduled to deliver in the region in the next three years currently sits at 38,000 units, with 16,426 of those units on the boards for DC proper. Of the 38,000 units, 14,747 are expected to deliver in 2019. 6,564 of the apartments delivering this year will be in DC, which would exceed the pace of development Mayor Bowser called for in her inaugural address earlier this month.

Unsurprisingly, 71 percent (over 11,600 units) of the residential pipeline for DC proper in the next three years is slated for the NoMa/H Street and Capitol Hill/Capitol Riverfront submarkets. The report notes that rising construction costs could have a ripple effect on development, likely in the form of slower deliveries and rising rents. "Longer multifamily development schedules are an inevitable consequence of higher construction costs," the report states.

Here is a quick snapshot of average rents for high-rise Class A apartments in DC area sub-markets, as defined by Delta:

- Alexandria: $2,107 per month

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,817 per month

- Upper Northwest: $2,795 per month

- Columbia Heights/Shaw: $2,664 per month

- NoMa/H Street: $2,377 per month

- Capitol Hill/Capitol Riverfront: $2,556 per month

- Rosslyn-Ballston Corridor: $2,481 per month

- Silver Spring/Wheaton: $1,939 per month

- Bethesda: $2,662 per month

- Northeast: $2,115 per month

- Crystal City/Pentagon City: $2,342 per month

Note: The rents are an average of studios, one and two-bedroom rental rates at Class A high-rise buildings in the DC area.

Definitions:

Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: apartment, class a apartments, delta associates, renting, vacancy rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/6500-class-a-apartments-will-deliver-in-dc-this-year/14884.

Most Popular... This Week • Last 30 Days • Ever

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

A report out today finds early signs that the spring could be a busy market.... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro